Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) -Rangebound–– Gold maintains the short-term bearish tone according to the daily chart, as indicators suggest a continued decrease in buying interest. The RSI maintains a negative slope below its midline, while the MACD shows that the bullish momentum is slowly fading

Long-term View (3-4months) -Positive –Any dips towards 50000 and 60000 should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively

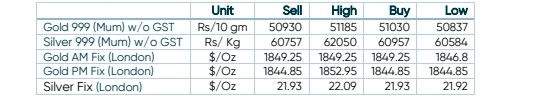

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Precious metal stalls, waiting for Inflation data for fresh cues

- International News – Gold prices haven’t done much of anything since mid-May, and have started June constrained in a range. Stability in the US Dollar and US Treasury yields – both real and nominal – turning higher represent headwinds for gold prices.

- Demand and Supply – – US mint sold 147,000 ounces of American Gold Eagles in varying

- Economic Data – – Investors were also awaiting crucial US inflation data due today to see if it had peaked or not.

- Domestic News– India imported 101 tonnes of gold in May, compared to 13 tonnes a year earlier due to Akshaya Tritiya and Wedding Season