Gold and Silver – Kya Lagta Hai

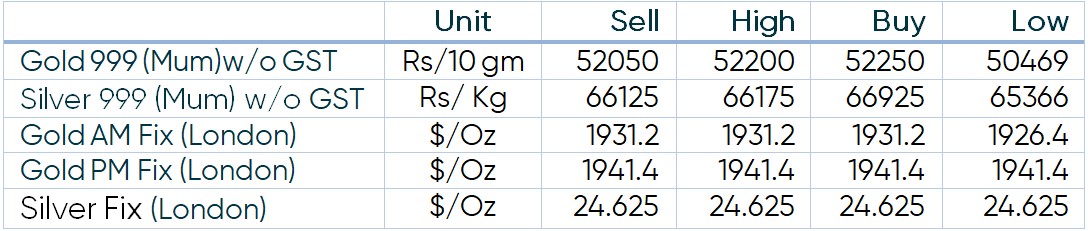

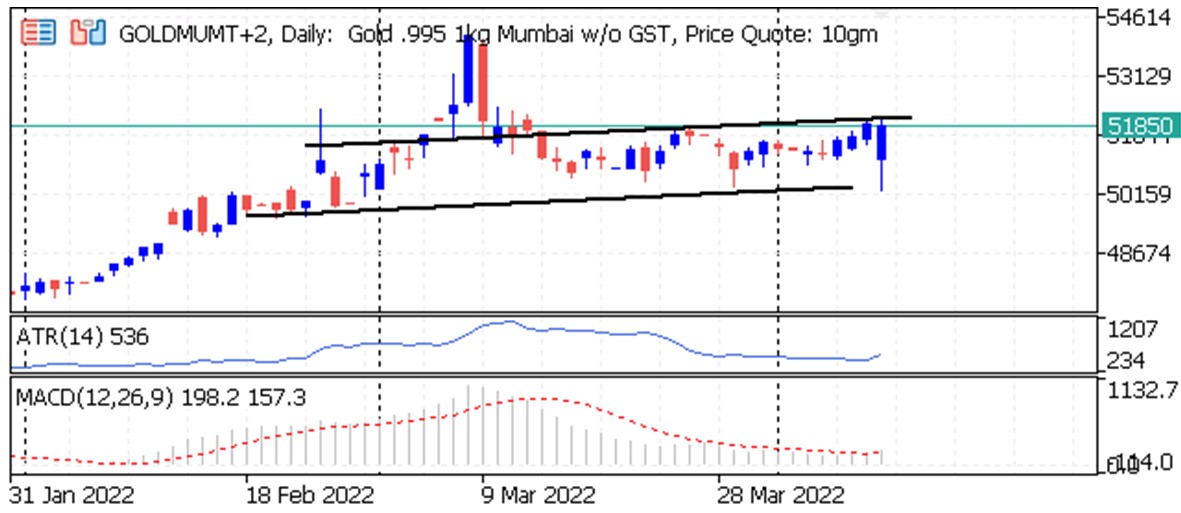

Short-term View (up to 1 week) – Sideways – Gold is finally trying to break its range of 50300 to 51800 while silver prices have also given an upside breakout from its descending triangle. Long-term View (3-4months) – Positive – Any dips towards 50000 and 65000 should be used as buying opportunity for target of 55000 and 75000 for Gold and Silver respectively.SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – Gold pricesrose about 0.7% on the week to trade around $1945. U.S. dollar strength and rising yields were offset by geopolitical risk and recession fears. Conflicting market forces create a neutral bias for gold in the short term

- Demand & Supply–Geopolitical uncertainty created by Russia’s invasion of Ukraine and the growing inflation threat generated solid support for gold-backed exchange-traded funds.187 tonnes of gold flowed into global ETFs in March and 270 tonnes in first quarter of 2022.

- Economic Data –The FED minutes released indicate that it plans to use a combination of interest rate increases and a rapid balance sheet run-off to bring the U.S. monetary policy to a more neutral position later this yearby unwinding approximately $3 trillion, taking its $9 trillion balance sheet down to $6 trillion over a three-year period.

- Domestic News– Around40 lakh weddings are expected to happen in India in April and May, which is likely to boast Gold demand.

Disclaimer