Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – – Consolidation –Gold and Silver prices are consolidating at its lows, waiting for cues for rebound Long-term View (3-4months) –Any dips towards 50000-51000 and 62000-63000 should be used as buying opportunities for the target of 55000 and 75000 for Gold and Silver respectively

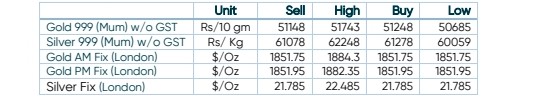

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – Bullion has been under pressure as the Federal Reserve tightened monetary policy to fight accelerating consumer-price gains. That helped push bond yields higher and has propelled a gauge of the US currency up around 6% since the end of March, weighing on gold.

- Demand and supply – In the last three weeks the SPDR Gold Trust has seen outflows equivalent to more than 38 tons of bullion, the biggest drop in over a year.

- Economic Data – In the last three weeks the SPDR Gold Trust has seen outflows equivalent to more than 38 tons of bullion, the biggest drop in over a year.

- Domestic News– Strong demand in India due to marriage season, for Gold as prices have retraced.

Disclaimer