Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Sideways – Gold is finally trying to break its range with next resistance 53000 while silverprices have also given an upside breakout from its descending triangle, next resistance at 68000. Long-term View (3-4months) – Positive – Any dips towards 50000 and 65000 should be used as buying opportunity for target of 55000 and 75000 for Gold and Silver respectively.

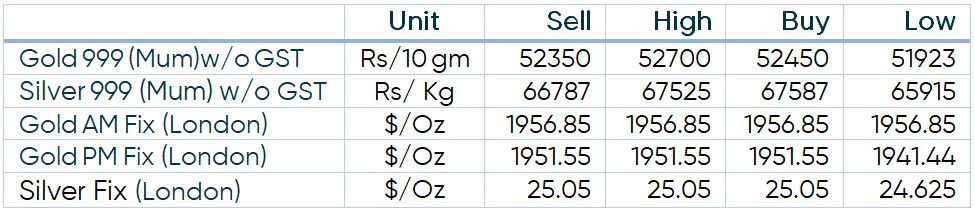

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – As we have been promoting, Gold prices are expected to be bullish this year due to Stagflation, even Goldman Sachs bank has come with a report stating Gold to touch$2500 this year, due to same reason.

- Demand & Supply–The Reserve Bank of India added 2.4t to their gold reserves in March, taking total gold reserves to 760.4t. Year-to-date, Indian official gold reserves have risen by over 6t.

- Economic Data –Supply disruption is causing global unrest,it is constantly pushing inflation higher. Watch CPI today for clue,as FED’s aggressive stance could risks slowdown & recession.

- Domestic News–India’s gold imports, which have a bearing on the country’s current account deficit (CAD), rose by 33.34 per cent to₹14 billion during the 2021-22 fiscal on account of higher demand, according to official data. Gold imports were worth ₹34.62 billion in 2020-21.

Disclaimer