This week, gold brushed up against Rs 48000, as it has done for the whole of 2021, but it lacked the fortitude to breakthrough. The yellow metal did not rally despite a surge in inflation and extremely low real interest rates. As a result, we may claim that gold has been particularly wicked this year and does not merit gifts from Santa. Perhaps it’s not gold’s fault, but our unrealistic expectations? After all, gold had to compete with cryptocurrencies and industrial metals (or commodities in general), which both outperformed gold during periods of high inflation. Gold did not break down despite the Fed’s aggressive rhetoric and tapering of quantitative stimulus.

As a result, everything is dependent on one’s point of view. The same can be said for historical assessments and 2022 estimates. The bears compare the current condition to the period between 2011 and 2013. The high in 2020 seems to be similar to the peak in 2011. As a result, following a time of consolidation, we could witness a significant drop, similar to what happened in 2013. Gold bulls, on the other hand, prefer to compare today to 2015 because the Fed’s interest rate hikes are only a few months away. As a reminder, gold bottomed in December 2015, therefore the expectation is for another bottom soon, followed by an upward trend. To put it another way, the bears feel the “taper tantrum” is still ahead of us, but the bulls believe the worst is already behind us.

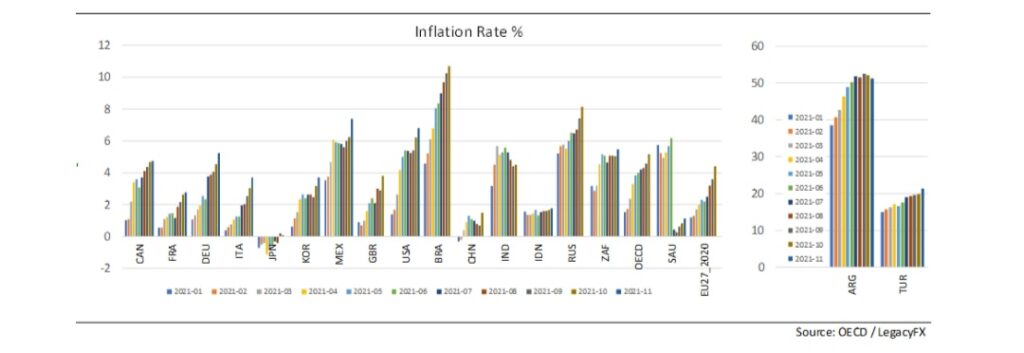

Inflation is perhaps the biggest challenge of 2022. In 2021, Inflation (CPI) has increased significantly in both advanced and emerging economies as we can see in the chart below. Except for India and Japan, all countries are witnessing high inflation every month on month in 2021.

2021 Monthly Inflation rates of OECD countries

In contrast to 2013, this year’s tapering was well-publicized and well-received by the markets. As a result, the worst may already be behind us. Especially since the 2020 economic crisis was both severe and brief, everything was compressed. I all, the Great Recession lasted over a year and a half, whereas the Great Lockdown barely lasted two months. The first taper tantrum took place in 2013, followed by the first raise in the federal funds rate in 2015.

Gold bears, on the other hand, bring out an essential fact: real interest rates haven’t yet normalised. Although nominal bond yields have recovered significantly since the August 2020 low, real rates have not. The cause for this was, of course, the recent increase in inflation. Inflation-adjusted rates, on the other hand, will rise if inflation falls. Another danger is that the Fed will surprise the markets by going hawkish.

In the end, Santa Claus may deliver a rod this year and not gifts to Gold. Although gold’s reaction to the previous FOMC meeting was positive, the yellow metal’s overall performance this month has been worse than the typically robust performance in December. Given the upcoming Fed tightening cycle and a likely peak in inflation, I don’t predict a similarly large downward swing as in 2013, although real interest rates could normalise considerably in 2022. The amount of debt will limit the breadth of the motion, but it will not change the overall direction.

Gold prices need to sustain above Rs 48500 to resume their uptrend to 52000 and Rs 55000 in 2022, with strong support at Rs 45500. I don’t expect a new high in Gold in 2022, as it is expected to trade in a range of Rs 46000 to Rs 55000.

Anyway, whether you are a gold bull or a gold bear, we wish you a truly merry and golden Christmas.