The precious metal appears to have evolved a Teflon coating, with every positive development or piece of news slipping straight by and having no effect on its market pricing. The dollar index has benefited from the broader financial and geopolitical situation, which is suitable for a haven alternative like gold.

Gold futures sank to a new three-month low, capping a fourth straight weekly loss, as the strong dollar reduces gold’s appeal as an inflation hedge. The 200-day smooth moving average has been breached by gold prices.

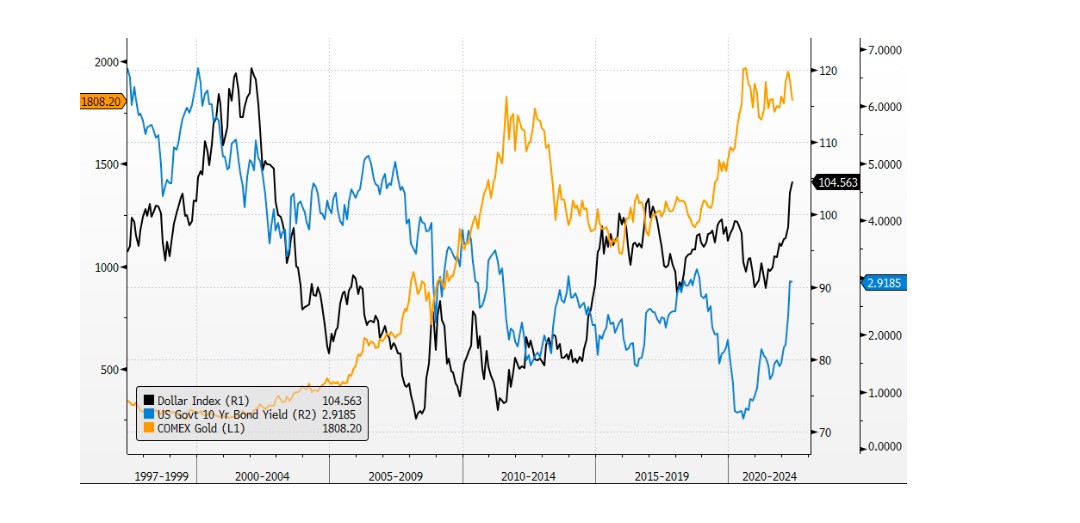

The dollar’s strength and rising interest rates are the two key factors weighing on gold. This year, the Dollar Index has increased by 7%. Because gold is priced in dollars and is seen as a safe haven when the currency falls, a strong dollar is detrimental to the metal. When the dollar is growing, there is no reason to own gold. Meanwhile, the 10-year Treasury yield has risen 143 basis points this year to 2.94 percent. Because gold does not pay interest, higher interest rates put pressure on it. As a result, rising rates make gold appear less appealing in comparison to bonds.

Gold has breached the major support of $1820 per ounce and is expected to drift lower towards $1780 per ounce, while gold prices in the domestic markets appear to be heading towards the critical support of 49000 per 10 gm. Even though prices are in an intermittent period of correction, we believe the broad trend in gold is strong as long as the closing level of 49000 per 10 gm holds.

Meanwhile, Indian gold ETFs witnessed a healthy net inflow of 2.1 tonnes in April, primarily driven by a rising gold price and safe-haven demand during the first half of the month; total holdings of gold ETFs increased to 38.5 tonnes. Retail demand remained robust during Akshaya Tritiya, surpassing pre-pandemic demand levels. Retail demand is expected to remain healthy in May due to the ongoing wedding season and lower gold prices.

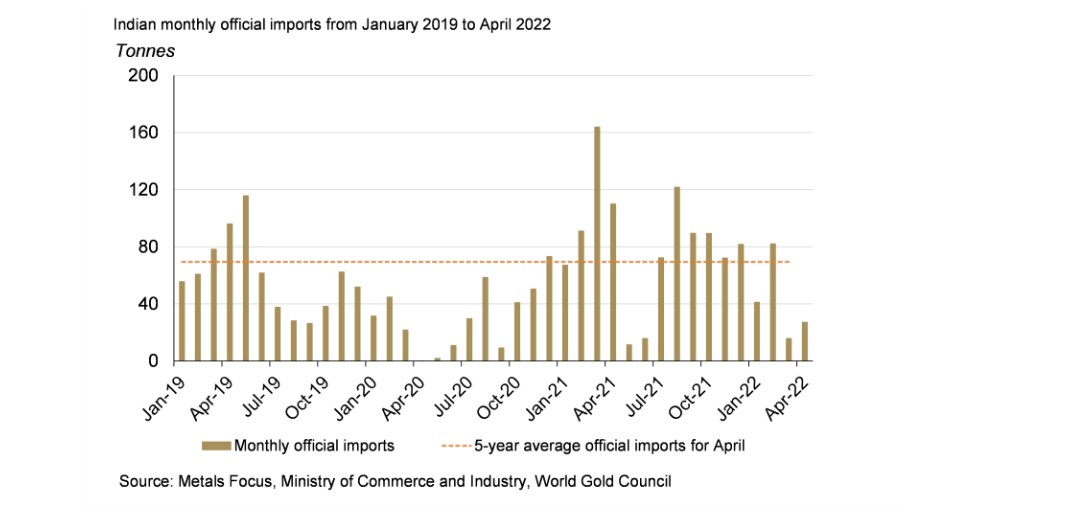

Indian official gold imports remained muted, however. Official gold imports in April were 27.1 tonnes – 75% lower y-o-y and higher than the import levels of 15.8 tonnes in March (72% higher m-o-m).

According to anecdotal evidence, gold demand was strong during Akshaya Tritiya, exceeding pre-pandemic demand in 2019. Due to the ongoing wedding season and the stable gold price, retail demand is projected to stay strong. Official imports may potentially increase as a result of a decreased gold price and trade restocking in anticipation for wedding purchases.