Precious Metals sustain gains on bruised Dollar

Gold began the week on a positive note, rising above $1800 for the first time since early July mid-week before losing traction. Precious Metals remained under slight negative pressure in the second half of the week, as the dollar remained surprisingly strong against its peers despite the disappointing inflation figures.

The US Bureau of Labor Statistics reported on Wednesday that inflation in the US, as measured by the Consumer Price Index (CPI), declined to 8.5% on a yearly basis in July from 9.1% in June. The labour market is still very tight and employment growth has not yet cooled down suggesting that wage growth will continue to run high. It is currently close to 6%, which is much too high to bring inflation back to 2% on a sustained way.

As a result, we continue to expect the Fed to raise rates by 75 basis points on September 21 in order to promptly return rates to neutral and restrictive territory. Although the likelihood of merely 50bp has grown, the decision will most likely be made by the next wave of payrolls and inflation data in early September. Fed funds futures traders now expect a 61.5 percent likelihood of a 50-basis-point increase in September, with a 38.5 percent possibility of a 75-basis-point increase.

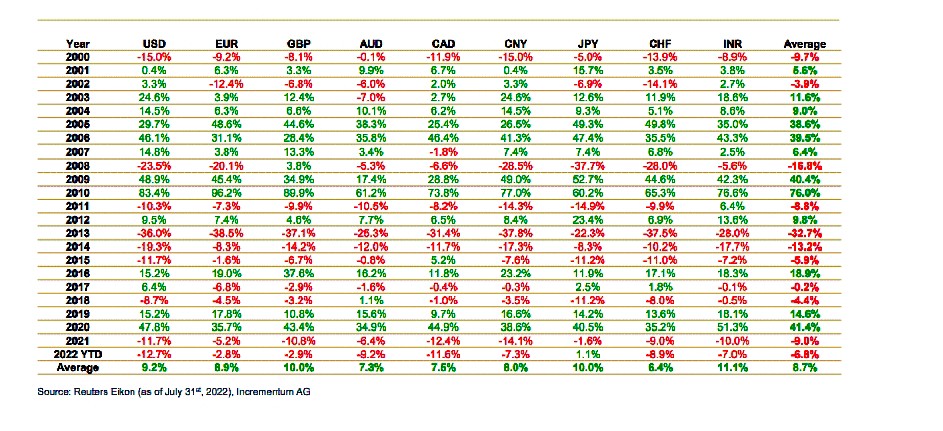

Gold performance in major currencies

The Federal Reserve will issue the minutes of its July policy meeting next week, and market investors will be looking for new signals about the amount of the US central bank’s next rate hike. Gold is highly sensitive to rising U.S. interest rates, as these increase the opportunity cost of holding non-yielding bullion. In the short run, gold and silver’s technical bullish bias remains intact. Fundamentally, gold is confronted with opposing factors here. On the one hand, a weaker US dollar helps, but the other side of the equation is the rise in yields. The overall outlook for precious metals is good, as the Federal Reserve will shortly end its interest rate hiking cycle.

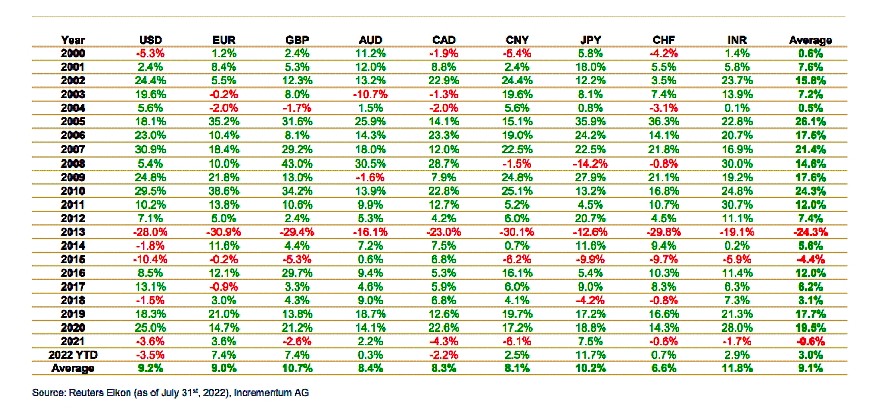

Silver Performance in different currencies