Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) –Weakness – While retaking the $1,650 level is a positive signal for gold, the yellow metal is still trading below the key $1,700 level, making it susceptible to more declines in the near-term. Long-term View (3-4months) – Positive –Any dips towards 49000 and 52000 should be used as buying opportunities for the target of 52000 and 60000 for Gold and Silver respectively in long-term.

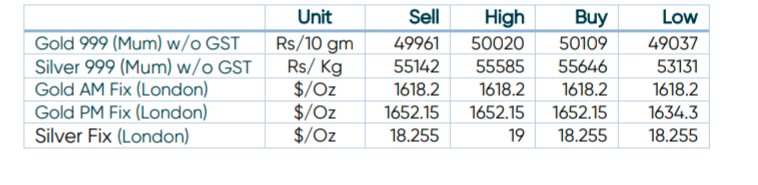

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – The plunge in over-hyped U.S. bond yields and the dollar has arrived. And it hasn’t disappointed gold bulls, who saw their biggest one-day gain in two month

- Demand – Global recession fears will likely remain the theme for the rest of the year and that should limit how far global bond yields end up going. Gold’s two-year low might be the bottom, if not it should be very close to it. Traders are now waiting to see if the decline in the dollar will be sustained, or just another blip before more upward movement. The factors that boosted the greenback- elevated inflation and a hawkish Federal Reserve- are still in play.

Disclaimer