By Dr. Renisha Chainani, Head Research, Augmont – Gold for All

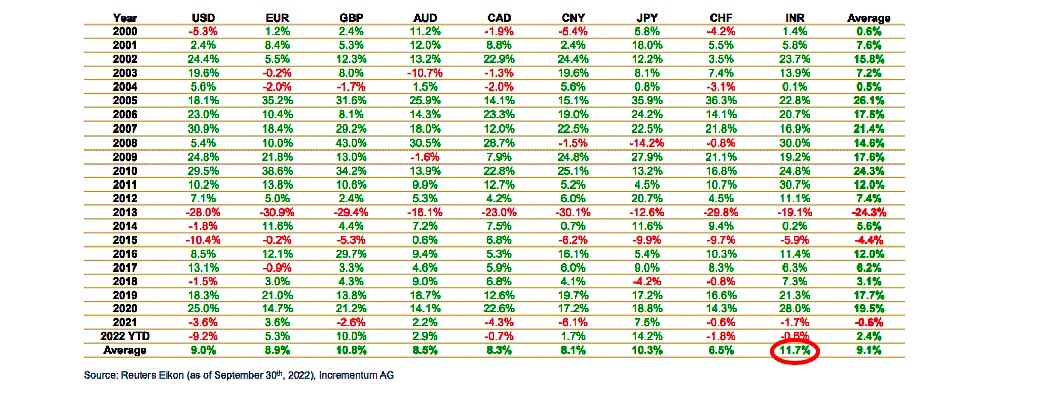

COMEX Gold has lost about 10 per cent so far since January while domestic gold prices have gained about 5 per cent due to weak Indian currency and high duties and taxes. If we look at historical performance, Indian Gold has better performed than Gold in other currencies. Indian Gold has given more than 11% CAGR returns in 20-year and 10-year periods.

Historical Gold performance in various currencies

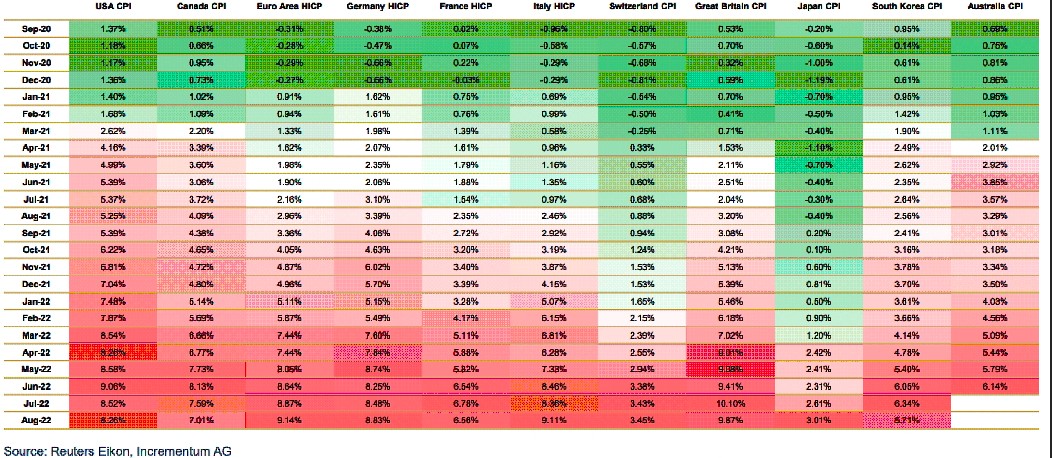

The world is in a volatile period: economic, geopolitical, and ecological changes all impact the global outlook. Inflation has soared to multidecade highs, prompting rapid monetary policy tightening and squeezing household budgets, just as COVID-19-pandemic-related fiscal support is waning. Since 2021, inflation has risen faster and more persistently than expected. In 2022, inflation in advanced economies reached its highest rate since 1982.

Peak Inflation out of sight in Developed Markets

Many low-income countries are facing deep fiscal difficulties. At the same time, Russia’s ongoing war in Ukraine and tensions elsewhere have raised the possibility of significant geopolitical disruption. Although the pandemic’s impact has moderated in most countries, its lingering waves continue to disrupt economic activity, especially in China. And intense heat waves and droughts across Europe and central and south Asia have provided a taste of a more inhospitable future blighted by global climate change.

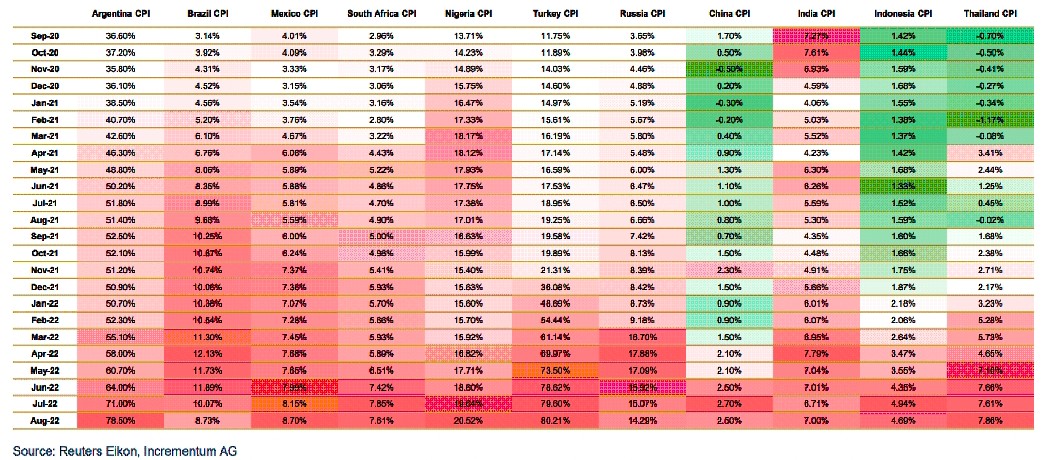

Peak Inflation out of sight in Emerging Markets

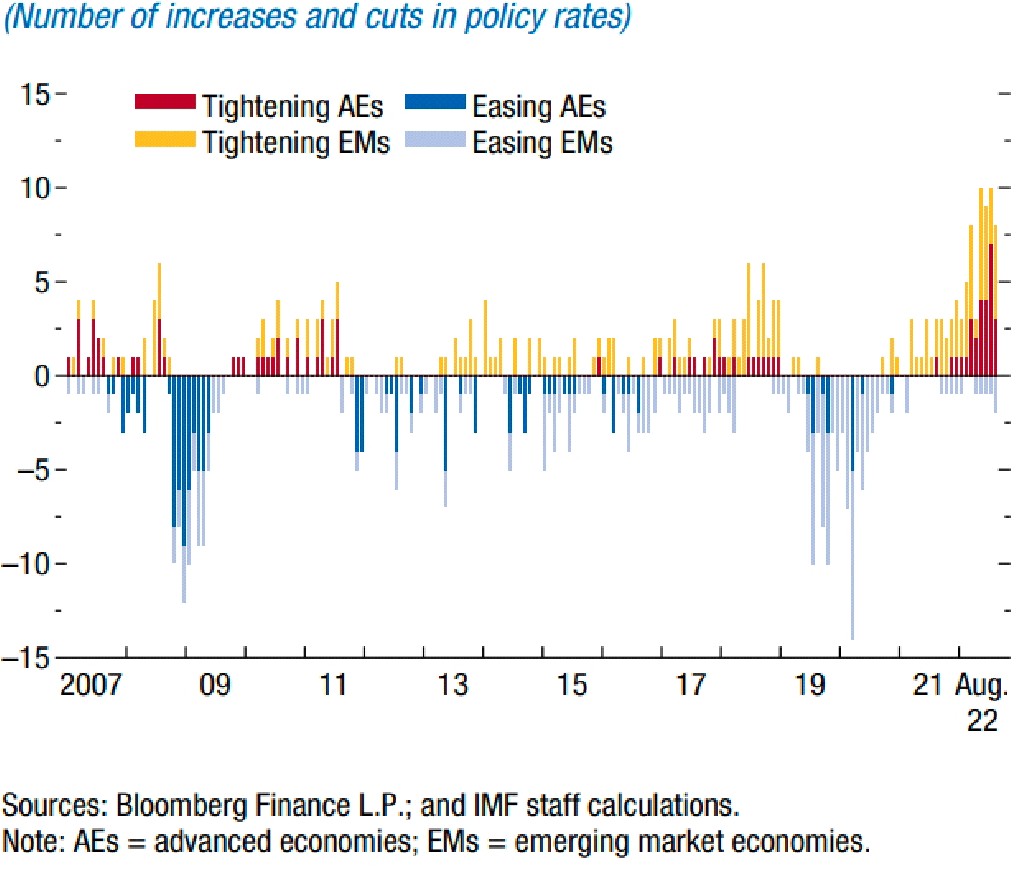

Central banks tackle stubbornly high inflation

The Federal Reserve has raised interest rates more aggressively than the European Central Bank in part because of differences in underlying inflation dynamics and economic conditions to date. Core inflation rose sooner and has run higher in the US than in the euro area, with tighter labor markets and a higher estimated output gap.

Changes in monetary policy cycle among G20 economies

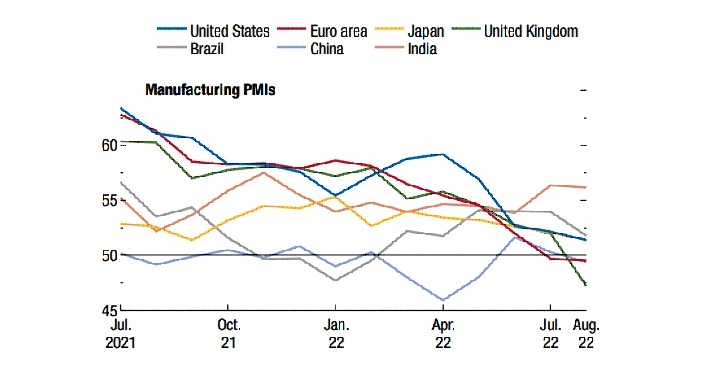

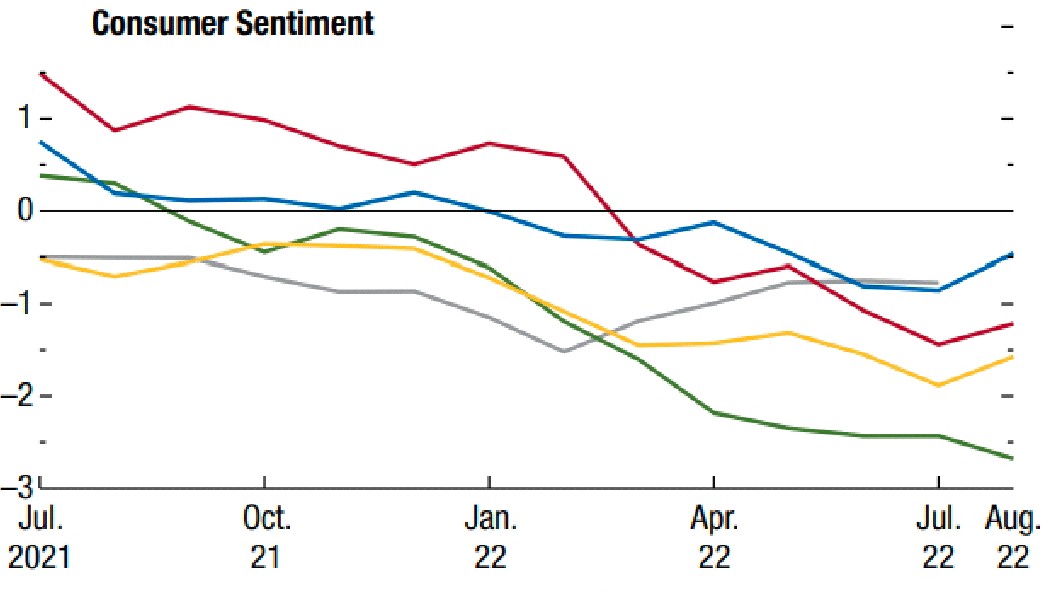

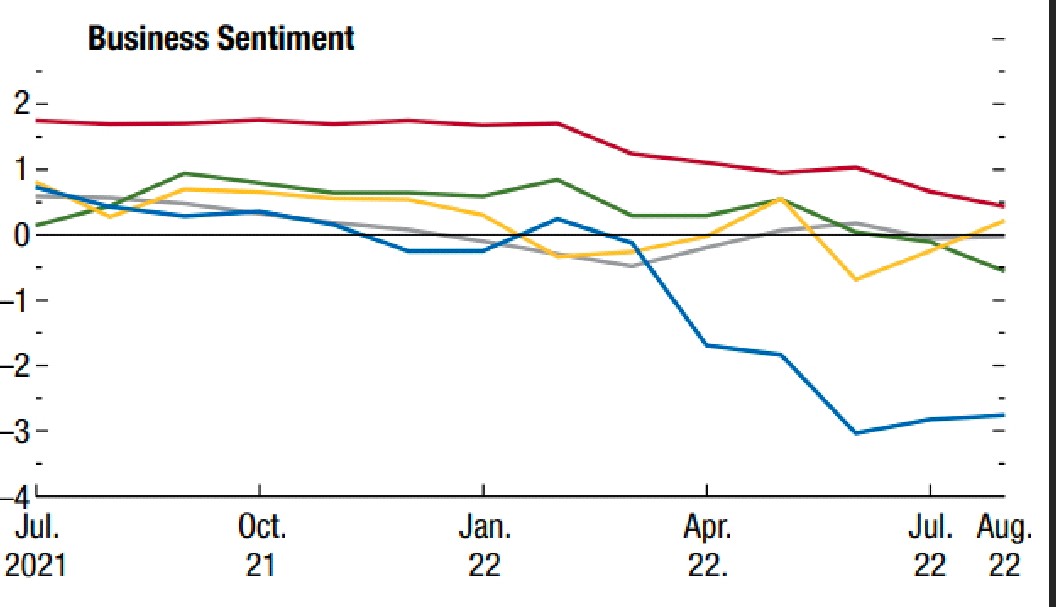

Leading indicators show signs of a slowdown

Global economic activity is experiencing a broad-based and sharper-than-expected slowdown, with inflation higher than seen in several decades. The cost-of-living crisis, tightening financial conditions in most regions, Russia’s invasion of Ukraine, and the lingering COVID-19 pandemic all weigh heavily on the outlook. Leading Indicators like Manufacturing PMI, Consumer sentiment and Business sentiment are pointing towards a slowdown ahead.

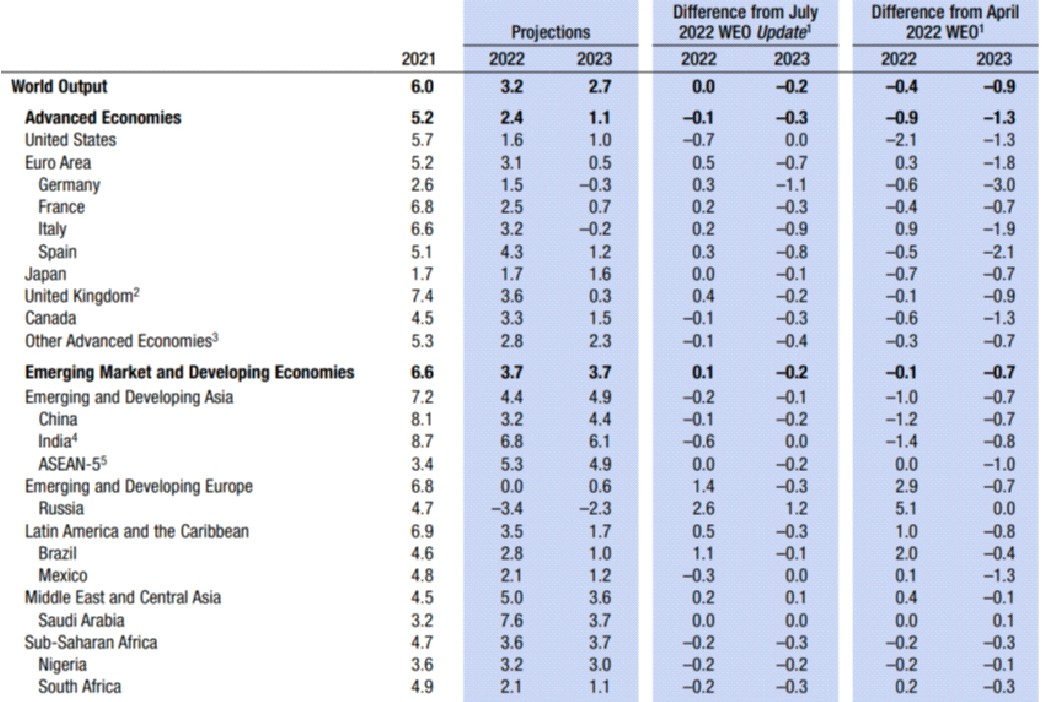

Global growth is forecast to slow from 6.0 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023. This is the weakest growth profile since 2001 except for the global financial crisis and the acute phase of the COVID-19 pandemic.

IMF Growth projections

The world’s three largest economies—China, the euro area, and the US—will slow significantly in 2022 and 2023, which will lead to safe-heaven demand for Gold in 2023. Moreover, Inflation is likely to decline and central banks will pause their tight monetary policy in the next 2-3 months, which will be supportive of Gold.

Weekly Gold Chart

The first Hurdle for Gold prices is Rs 52000, it prices sustain above it, it can touch Rs 55000 and 58000 by Diwali next year. While the downside seems very limited, the recent low of Rs 49000 is very strong support.

Wish you a very prosperous Diwali and a Happy New Year!!!