Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rebound – Gold needs to sustain above $1700, to see a rebound and start trending higher. Long-term View (3-4months) – Positive – – – Any dips towards 50000 and 55000 should be used as buying opportunities for the target of 52000 and 60000 for Gold and Silver respectively in long-term.

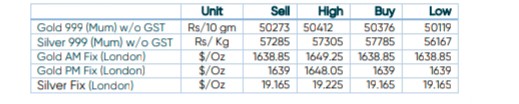

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – – Gold slipped yesterday en route to its seventh straight monthly decline, hurt by a stronger dollar and elevated U.S. bond yields, while markets looked forward to this week’s Federal Reserve meeting for more clarity on its rate-hike path.

- Economic Data – – Markets are likely to be in a wait-and-see mode until the Fed’s decision and with rate increases largely priced in, it will take an unexpectedly smaller or larger move to impact markets. The Fed is widely expected to deliver a fourth straight 75 basis-point increase at Nov. 1-2 policy meeting and U.S. rate hikes increase the opportunity cost of holding zero-yielding bullion.

Disclaimer