Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Positive – – – Gold and Silver prices are continuously getting support on uptrend line. Next resistance for gold is 55000 and for Silver 70000

Long-term View (3-4months) Positive – –Gold has made Inverse Head and Shoulder pattern on daily charts. Neckline resistance is $1820. If prices sustain above it, target would be $2020.

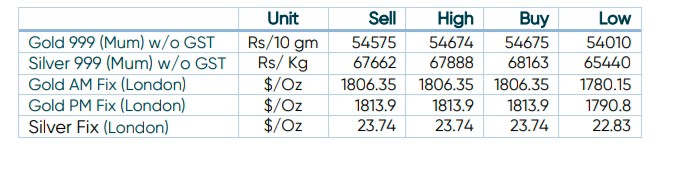

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

International News –– Bullion is gathering pace as the flash US PMI Composite Output Index came at 44.6 in December, down from 46.4 in November. It was the sharpest decline in business activity since May 2020, excluding the initial pandemic period, since the Great Recession. The strong decrease in new orders drove the decline in business activity, as inflation and higher interest rates dampened demand.

Silver– The supply of silver has been shrinking even more rapidly than gold on COMEX Warehouses. The drainage since the start of the year has been nothing short of spectacular. 48.5M ounces have left Registered since Jan 1. That represents more than 50% of the balance of 82M ounces last Dec 31. The silver Registered Ratio reached as low as 11.1% of total inventory on December 7th. This is the lowest the ratio has been since at least January 2000!