By Dr. Renisha Chainani, Head-Research, Augmont – Gold for All.

In 2022, a lot has happened. Ukraine was been invaded by Russia. North Korea launched missile after missile. Latin America has shifted to the left. The United Kingdom lost a queen, gained a king, and had three Prime Ministers. President Xi Jinping was re-elected for a record-breaking third term as General Secretary of the Communist Party of China, further solidifying his hold on power. Protests have erupted across Iran. The global population has surpassed 8 billion people.

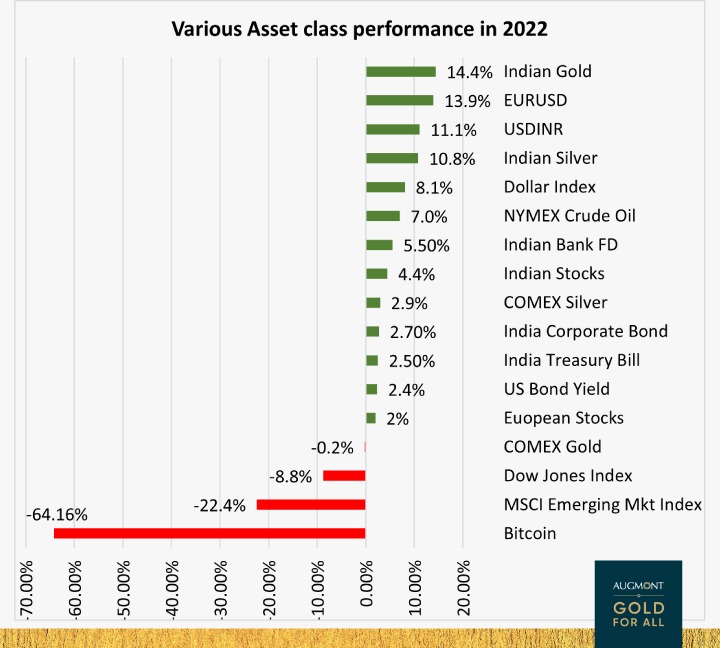

In terms of economics, inflation reached 9%, while the central bank raised interest rates. The ECB has also joined the hawkish camp. The FED, in particular, increased the federal funds rate by more than 4 percentage points to 4.52-4.50 per cent. As a result, bond yields and the US dollar rose, while cryptocurrencies plummeted.

When we examine the various asset class performances in which Indians prefer to invest their money, Indian gold emerges as the best performer in 2022. A portfolio with gold not only gives a better return, but gold also always plays the role of an Inflation hedge, safe heaven hedge and hedge against uncertain times.

Gold is set to emerge as one of the most preferred savings instruments for 2023. The global economy is at an inflexion point after being hit by various shocks over the past year. As central banks aggressively fought against inflation, gold emerged as one of the most preferred investment options. Going forward, this interplay between inflation and central bank intervention will be key in determining the outlook for 2023 and the yellow metal’s performance. It is always advised to put 15-20% of the portfolio in Gold for portfolio diversification.

The best way to stay invested in gold is through Augmont Digital Gold SIP every month for better returns. Those who have missed this 2022 rally, can still take advantage as targets for 2023 are Rs 60000 for Gold as recommended in “Inverse Head and Shoulder pattern target Rs 60000 for Gold in 2023“ blog and Rs 85000 Silver as recommended in “25% upside expected in Silver in 2023“ blog. Do not miss to watch this space every weekend in 2023 for further targets.

2 Comments. Leave new

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?