Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) –Rebound–– Gold is trading in a channel with lower highs and lower lows. Next target level it could touch is 52000. While Silver has retraced almost 23.6% from its lows, next level to watch for is 50% retracement 63700.

Long-term View (3-4months) -Positive – Any dips towards 50000 and 60000 should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively

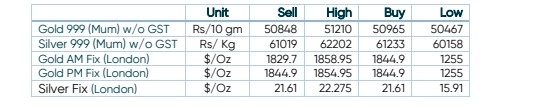

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Investors are waiting for US jobs data for Fed rate path clue

- International News – Gold held a gain as increasing fears of a recession in the world’s largest economy burnished its appeal as a haven asset.

- Demand and Supply – From late February to mid-March 2022, gold prices surged, mostly on ‘haven flows’ due to the war in Ukraine. In the following six weeks to mid-April, gold remained high, while US real rates shot up. However, gold has fallen back recently and reconnected to its main driver, real yields. .

- Economic Data– The market is waiting for US jobs data due Friday, which may provide a steer on whether a recession is likely and on how quickly the Fed will raise rates.

- Domestic News– Gold discounts widened in India this week as demand faltered due to rise in prices, while demand in top consumer China was yet to see a substantial pick-up as COVID-induced restrictions were being gradually eased.