Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) –Positive– Gold and Silver prices are seeing some profitbooking after a sharp runup. Long-term View (3-4months) -Positive – Any dips towards 50000 and 65000 should be used as buying opportunity for target of 55000 and 75000 for Gold and Silver respectively

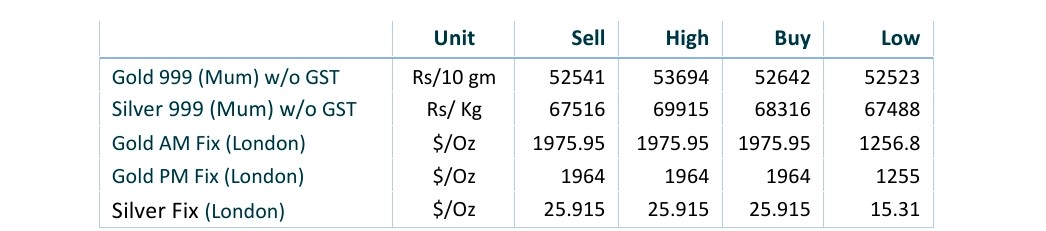

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – Gold slipped the most in three weeks as U.S. Treasury yields surged following stronger-than-expected U.S. housing data..

- Demand & Supply– Global Gold ETF demand is very strong adding 17 tonnes last week and 8 tonnes of gold this week.

- Economic Data – New U.S. home construction rose unexpectedly in March to the highest level since 2006, boosted by multifamily projects as builders seek to replenish housing inventory. Treasury yields surged across the curve Tuesday following the data release, and a selloff in bonds boosted the yield on the benchmark 30-year bond above 3% for the first time in three years. Eurozone Industrial Production and US Existing Home sales data to be focused today.

- Domestic News– The Reserve Bank of India has released dates for the premature withdrawal of Sovereign Gold Bonds (SGB) issued under different tranches for premature redemption during H1 of 2022-23, i.e., from April 1, 2022 to September 30, 2022, along with a window for submission of request for premature redemption

Disclaimer

1 Comment. Leave new

cfJG