Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rebound – Gold and Silver prices rebound from psychological support, as it was oversold and investors rush for bottom fishing.Long-term View (3-4months) –Positive – Any dips towards 50000 and 60000 should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively

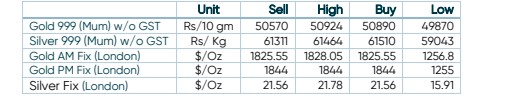

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Bullion prices rebound as dollar and yields dip

- International News – Gold rose over 1% yesterday as a slide in the dollar and Treasury yields burnished bullion’s safe-haven appeal after weak U.S. jobs numbers compounded economic concerns.

- Demand and supply – Gold is attracting safe-haven flows as the focus has shifted to the weakness in the U.S. with jobless claims rising and all the negative talk about inflation. There is good amount of pessimism with regards to global stocks

- Economic Data – Second-tier economic details, headlines concerning Russia, coronavirus will be important for fresh directions.

- Domestic News– Gold imports rose 33.3% in FY22 to 837 tonnes, or 12% more than the pre-pandemic annual average of FY16-20.

https://insights.augmont.com/disclaimer