Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Retracement – Gold and Silver prices are seeing some retracement in rally after a sharp runup. Long-term View (3-4months) -Positive – Any dips towards 50000 and 65000 should be used as buying opportunity for target of 55000 and 75000 for Gold and Silver respectively

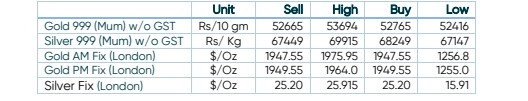

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – Gold is proving remarkably resilient, gaining almost 7% this year as investors shrug off surging real yields and strengthening dollar to focus on political and economic risk. The International Monetary Fund on Tuesday cut its forecast for global growth to 3.6 percent in 2022 from its January estimate of 4.4 percent, citing inflation and the Russia-Ukraine conflict as factors.

- Demand & Supply – While traditional yield and currency drivers suggest bullion is overvalued, demand for the haven asset remains strong. Global Gold ETF demand is very strong adding 17 tonnes last week and 8 tonnes of gold this week.

- Economic Data – The global economic outlook remains murky as a robust recovery from the pandemic is tempered by the war in Ukraine and China’s continuing battle against Covid-19. Any escalation in the conflict, which is already weighing on growth forecasts, could further burnish the appeal of gold.

- Domestic News– The Reserve Bank of India has released dates for the premature withdrawal of Sovereign Gold Bonds (SGB) issued under different tranches for premature redemption during H1 of 2022-23, i.e., from April 1, 2022 to September 30, 2022, along with a window for submission of request for premature redemption

Disclaimer