Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) –Rebound–Gold and Silver prices haverebounded from psychological support, as it was oversold and investors rush for bottom fishing.

Long-term View (3-4months) -Positive – Any dips towards 50000 and 60000should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively

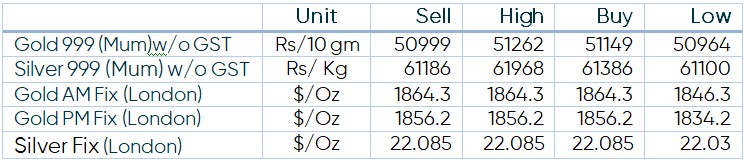

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News –Gold prices touched a more than one-week high on Monday, as an easing dollar supported greenback-priced bullion, although rising U.S. Treasury yields capped gains.

- Demand and Supply – If we look at US CFTC data, speculators for gold futures raised short positions by more than 35 per cent from the lows in late March.

- Economic Data– US Fed Chairman Jerome Powell this week said that the Fed will keep raising interest rates until there is “clear and convincing” evidence that inflation is in retreat.

- Domestic News–Gold imports rose 33.3% in FY22 to 837 tonnes, or 12% more than the pre-pandemic annual average of FY16-20.