Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Oversold – As Gold and Silver have retraced, prices are oversold, we could see bottom fishing supporting prices ahead this week.

Long-term View (3-4months) – Positive – Any dips towards 50000-51000 and 64000-65000 should be used as buying opportunity for target of 55000 and 75000 for Gold and Silver respectively

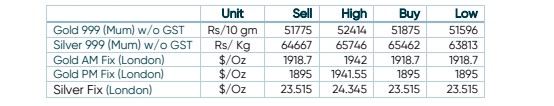

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – – Gold prices slipped further on Monday as prospects of aggressive policy tightening by the US Federal Reserve and a stronger dollar dimmed the precious metal’s safe haven appeal.

- Demand & Supply – Global Gold ETF demand is very strong adding 12 tonnes last week with current holdings of 3329 tonnes now.

- Economic Data – Dollar Index is sustaining above 100 level. The main catalyst for the ongoing dollar’s demand came from China, as the country seems unable to control the coronavirus outbreak, now spreading into some Beijing districts. Companies halting operations in the area are expected to steepen current supply-chain issues to the detriment of local and global growth.

- Domestic News–Retail demand remained sluggish during March as buyers postponed purchases in anticipation of a correction in the gold price.

Disclaimer