Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) –Rangebound – Gold is trading in a channel with lower highs and lower lows. Next target level it could touch is 52000. While Silver has retraced almost 23.6% from its lows, next level to watch for is 50% retracement 63700.

Long-term View (3-4months) -Positive – Any dips towards 50000 and 60000 should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively

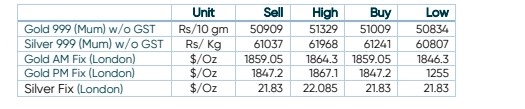

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

FED minutes points to more rate hikes than market anticipates

- International News –Fed minutes released Wednesday indicated that officials are prepared to move ahead with multiple 50 basis points interest rate increases. The minutes indicate that members are hopeful they can bring down inflation, but also concerned about financial stability risks.

- Demand and Supply -Retail investors reach for gold to counter crypto risk

- Economic Data–Despite lingering inflation, market participants doubt how tight the US Federal Reserve monetary policy could be. Speculative interest is now considering two potential 50 bps hikes and then a less aggressive stance.

- Domestic News–Gold imports rose 33.3% in FY22 to 837 tonnes, or 12% more than the pre-pandemic annual average of FY16-20.