Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound–Gold is again trading in same range 50200 to 51200 and silver range is 59000 to 62500

Long-term View (3-4months) – Positive – Any dips towards 50000 and 60000should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively

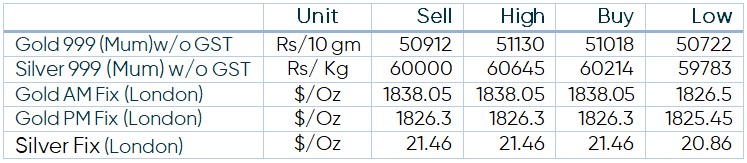

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News –Gold is displaying back and forth moves in a narrow range.The upbeat US Durable Goods Orders released on Monday have raised the odds of a consecutive 75 basis point (bps) rate hike by the Federal Reserve. Investors were worried over the fact that growth prospects might not remain supportive of more policy tightening.

- Demand and Supply – IndianRetail demand is expected to remain soft in June as the wedding season ends and the crop season begins ahead of the monsoon. With soft demand and ample inventories, the local market remained in discount, averaging US$5-6/oz during the first three weeks of June.

- Economic Data–The continued weighing on investors’ sentiment and triggered a fresh wave of the global risk-aversion trade, which, in turn, offered some support to the safe-haven gold.

- Domestic News–Gold ETFs in India have seen small positive inflows so far in June, likely driven by continued market volatility and a depreciating rupee. The RBI added 3.7t to its gold reserves in May, the highest monthly addition since December 2021 (also 3.7t). This took total gold reserves to 765.1t (7.5% of total reserves).