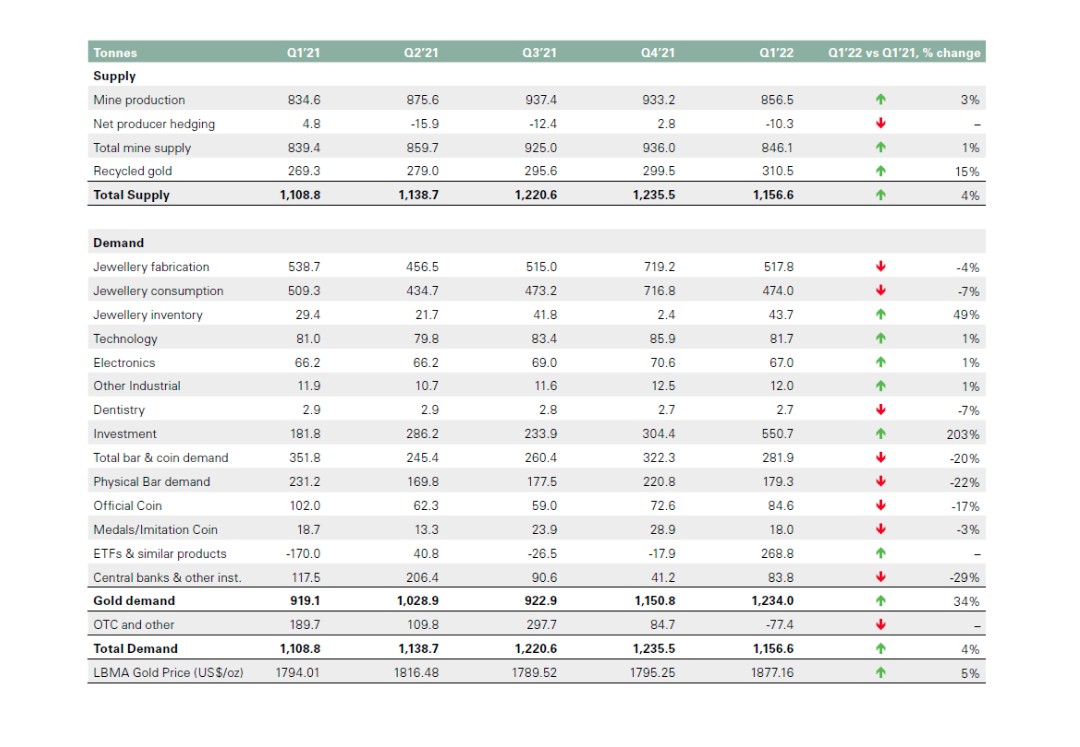

World Gold Council has released its Gold Demand trends for Q1 2022. Following are the highlights:

• Gold ETFs had their strongest quarterly inflows since Q3 2020, fuelled by safe-haven demand. Holdings jumped by 269 tonnes, more than reversing the 174 tonnes annual net outflow from 2021.

• Bar and coin investment was 282 tonnes in Q1, 20% lower than the very strong Q1’21 but 11% above its five-year quarterly average. Renewed lockdowns in China and historically high local prices in Turkey were key contributors to the y-o-y decline.

• Jewellery consumption lost momentum in Q1: demand was down 7% y-o-y at 474 tonnes. The drop was largely due to softer demand in China and India.

• Central banks added 84 tonnes to global official gold reserves during the first quarter. Net buying more than doubled from the previous quarter but fell 29% short of Q1’21.

• The technology sector had a steady start to the year: demand of 82 tonnes was the highest for a first quarter since 2018, driven by a modest uptick in gold used in electronics.

• The supply of recycled gold jumped to 310 tonnes (+15% y-o-y). This was the strongest first quarter for gold recycling activity for six years.

• Indian bar and coin investment increased 5% y-o-y to 41 tonnes – the strongest first quarter since 2014. Retail investors focused on gold’s safe haven attributes amid volatility in local equity markets and the war in Ukraine.

Gold Supply and Demand – Q1 2022