Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) –Rebound–Gold is trading in a channel with lower highs and lower lows. Next target level it could touch is 52000. While Silver has retraced almost 23.6% from its lows, next level to watch for is 50% retracement 63700.

Long-term View (3-4months) -Positive – Any dips towards 50000 and 60000 should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively

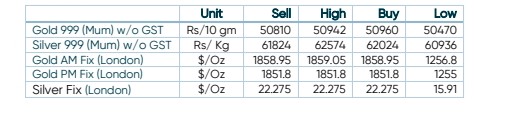

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

3% Dollar Index fall leads to 4.5% rally in Gold in last 2 weeks

- International News –Gold has been supported by moderation in market expectations from the FED’s monetary policy, and most importantly the weaker U.S. dollar. A 3% fall in Dollar Index from levels of 105 to 102 in last two weeks have led to 4.5% rise in gold prices after touching low of $1785

- Demand and Supply – In the current market environment, which is characterized once again by higher risk appetite among market participants, gold is not in much demand

- Economic Data– EU Inflation, Fed Unwinds, China PMI in focus this week.

- Domestic News–Gold discounts widened in India this week as demand faltered due to rise in prices, while demand in top consumer China was yet to see a substantial pick-up as COVID-induced restrictions were being gradually eased.