Gold and Silver – Kya Lagta Hai

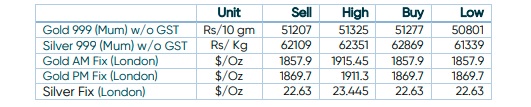

Short-term View (up to 1 week) – Oversold – As Gold and Silver have

retraced, prices are oversold, and we could see bottom fishing

supporting prices this week. Long-term View (3-4months) -Positive – Any dips towards 50000-51000 and 62000-63000 should be used as buying opportunities for the target of

55000 and 75000 for Gold and Silver respectively

Important News and Triggers

- International News – Gold and Silver prices have slumped from last 10 days on anticipation of FED rate hike and this negative news is already discounted in the

prices now. Tonight, when FED will actually announce rate hike, prices are expected to rebound as per saying “Sell on Rumors and Buy on News” - Demand & Supply – – Global Gold ETF has seen some outflows from last one week. Holdings have reduced from 3329 tonnes to 3317 tonnes in last 7-8 days

- Economic Data – As per the CME’s Fed Watch tool, traders are overwhelmingly (99%+) pricing in a 50bps interest rate hike to the 0.75-1.00% range, which would

mark the first 0.50% increase to rates since 2000. - Domestic News– Akshaya Tritiya gold sales is estimated to be 30-40% higher than the last year in India

Disclaimer