Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Sideways – Gold is expected to trade in range of 50300 to 51800 while silverprices are trading in descending triangle formation with support at 65000 and resistance at 66000

Long-term View (3-4months) – Positive – Any dips towards 50000 and 65000 should be used as buying opportunity for target of 55000 and 75000 for Gold and Silver respectively

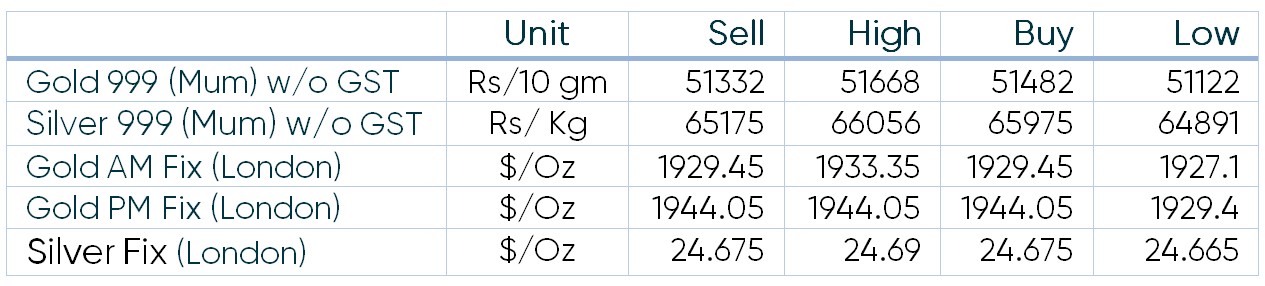

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News–Precious Metal prices eased yesterday as the dollar held firm on rising prospects of further sanctions against Russia and possibly more aggressive interest rate hikes by the US Federal Reserve to rein in inflationary pressures.

- Demand & Supply–Rising inflation and safe-haven demand resulted in extraordinary demand for physicalgold in March. the U.S. mint reported that it sold 155,500 ounces of various denominations of its American Eagle Gold bullion coins, up 73% from last month. The U.S. Mint saw its best March performance since 1999.

- Economic Data –Europe PMI 54.9, UK PMI 60.9 and US PMI came in at 57.7 yesterday, which suggests steady Manufacturing Index. Focus now turns to today’s Fed minutes release as gold bears eye a test of recent sub-$1900 lows.

- Domestic News– Around40 lakh weddings are expected to happen in India in April and May, which is likely to boast Gold demand.

Disclaimer