Hereby we present, the highlights of the World Gold Council’s Gold Demand Trends Report which talks about Gold Market Fundamentals in Q1-2021.

GOLD DEMAND HIGHLIGHTS

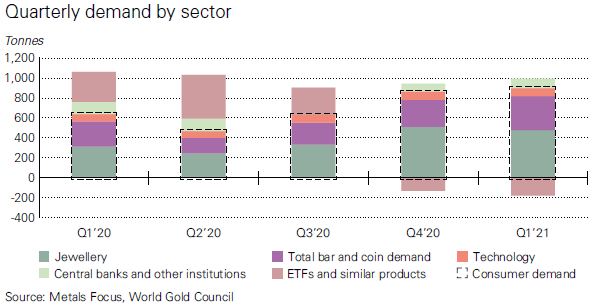

- Q1 2021 gold demand (excluding OTC) was 815.7t, virtually on a par with Q4 2020, but down 23% compared with Q1 2020. While the average gold price in Q1 was 13% higher y-o-y, it declined by 4% q-o-q1. The opportunity to buy at lower prices, relative to the highs seen last year, boosted consumer demand, particularly as many markets continued to emerge from lockdown and economic recovery lifted sentiment.

- Demand for gold bars and coins saw a third successive quarter of growth. Investment in these products reached 339.5t – the highest quarter since Q4 2016. Jewellery demand of 477.4t was 52% higher than the very weak Q1 2020. The value of jewellery spending – US$27.5bn billion (bn) – was the highest for a first-quarter since Q1 2013. Bar and coin investment of 339.5t (+36% y-o-y) was buoyed by bargain-hunting, as well as by expectations of building inflationary pressures. Following the shock of 2020, jewellery demand recovered in Q1 but remained subdued compared with previous historical levels.

- Global gold ETF holdings fell by 177.9 tonnes (t) (US$9.5bn). Western markets drove outflows as US rates rose sharply and the US dollar strengthened. Growth in consumer demand was offset by strong outflows from gold-backed ETFs (gold ETFs), which lost 177.9 in Q1 as higher interest rates and a downward price trend weighed on investor sentiment.

- Global central bank gold reserves grew 95.5t in Q1. Hungary’s large purchase (63t) bolstered Q1 buying, more than matching Turkey’s substantial sale (31.5t). Q1 saw continued healthy levels of net buying by central banks: global official gold reserves grew by 95.5t, 23% lower y-o-y, but 20% higher q-o-q.

- Substantial wedding purchases, encouraged by declining gold prices, and improving consumer sentiment buoyed by a pick-up in economic activity, supported Indian gold jewellery demand in Q1. Demand was 39% higher y-o-y at 102.5t, although it fell short of the 125.4t from Q1 2019. The value of jewellery demand in Q1 grew 58% y-o-y to a first-quarter record of Rs431bn. Robust retail demand pushed the local market gold price premium to a 51-month high of US$7/oz in early March.

- Gold used in technology grew 11% y-o-y in Q1 as consumer confidence continued to recover. Demand of 81.2t was just above the five-year quarterly average of 80.9t.

GOLD SUPPLY

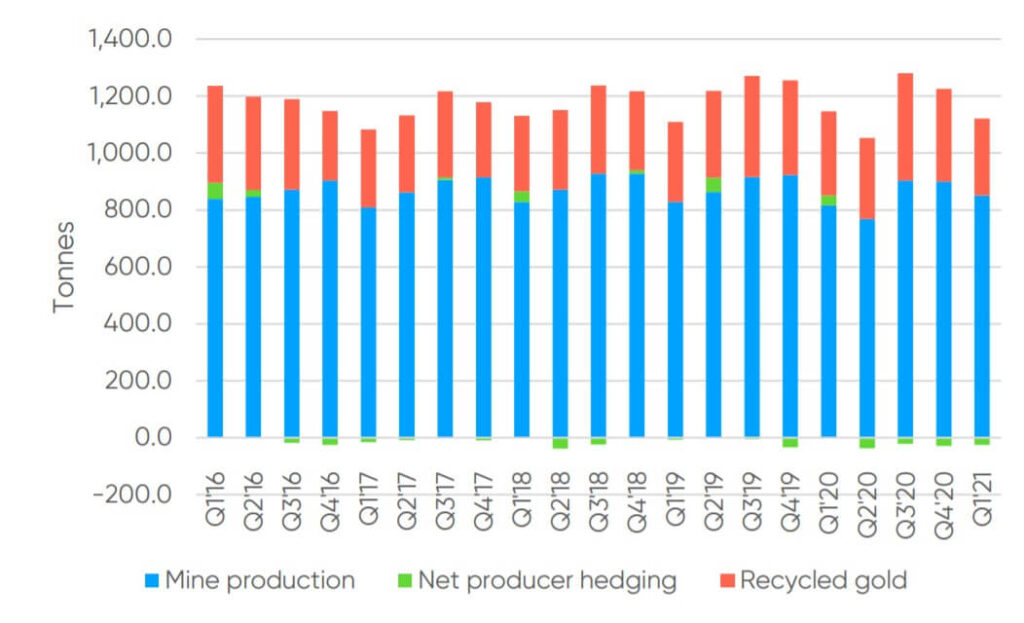

- Total supply of gold fell 4% y-o-y in Q1, Mine production growth was outweighed by a drop in recycling, largely in response to weaker gold prices.

- The overall fall in supply in the first quarter illustrates the importance of recycling and producer hedging to the gold market.

- With the gold price more than 10% below all-time highs and easily available supplies of old gold jewellery having already been sold in reaction to the strong up-leg in the gold price to the August 2020 peak, recycling fell 8% y-o-y and 17% q-o-q.

- Producer de-hedging of 25.0t contrasts with 34.7t of new hedging in Q1 2020 and together these sources of supply offset an increase in mine production to a record for the first quarter of any year.

- Improved economic activity in India, especially in the rural sector, along with expectations of a higher gold price, appears to have reduced recycling volumes.

It is also possible that the strong global fiscal response to mitigate the economic effects of the coronavirus pandemic has reduced the need for distressed sales of gold, in contrast to the mostly monetary actions seen during and after the 2008 Global Financial Crisis. Looking ahead, we believe annual mine production looks set to hit a new all-time high in 2021, barring unexpected disruptions, but recycling is likely to remain subdued.