Cryptocurrencies became popular –when Bitcoin’s price touched the price around $1200 which was the value of one ounce of Gold in March 2017 – the movement to a crypto gold rush began, with multiple projects presenting their tokens backed by the precious metal. Gold-backed cryptocurrency is a type of crypto stable coin where each token is backed with physical gold. With the token price pegged to the current gold price, there is less price volatility compared to Bitcoin or other altcoins.

By nature, gold-backed cryptocurrencies work similarly to digital assets. You can purchase and sell them via crypto exchanges, hold them in your wallet, and you can usually sell them anytime you wish. Like Bitcoin, gold-backed tokens are powered by blockchain technology, which – among other features – allows you to trade digital assets 24 hours a day, 365 days a year.

Gold-backed cryptocurrency tokens have emerged as a new, commodity-pegged stable coin in the crypto market. Developers have had an interest in creating a gold-backed digital currency since the earliest days of the industry. Gold-backed digital currencies link one token or coin to a specific quantity of gold (for instance, 1 token equals 1 gram of gold). The gold, like dollars or other fiat currency, must be held in reserve, typically by a third party.

InfiniGold launched PMGT (Perth Mint Gold Token) as the first digital gold token on a public block-chain backed by government-guaranteed gold. PMGT allows you to trade and hold gold stored at The Perth Mint on the blockchain. PMGT tokenises GoldPass certificates, where 1 PMGT = 1 oz.

The last few years have seen the creation of block-chain projects that claim to have tokens backed by physical gold. There’s a bunch of blockchain networks that claim to leverage physical gold to back certain tokens. For instance, Digixglobal has a token called DGX, which represents 1 gram of 99% LMBA standard gold, Tether Gold (XAUT) token represents one troy fine ounce of gold. Additionally, there’s also Darico (DEC), Block note (BNO), Aurusgold (AWG), Cash telex (CTLX), Blockstock (BSO, Coinshares/Blockchain.com MKS (DGLD), G-coin (XGC), Goldnugget (GNTO), Goldmint (MNTP), Goldfund (GFUN), Gramgold coin (GGC), PAX gold (PAXG), Karatgold coin (KBC), and HelloGold (HGT) to name a few.

Gold-backed cryptocurrency tokens have emerged as a new, commodity-pegged stable coin in the crypto market. While 30 Gold-Backed Crypto Attempts Have Failed, 77 Existing Blockchain Projects Attempt to Leverage the Precious Metal’s Backing.

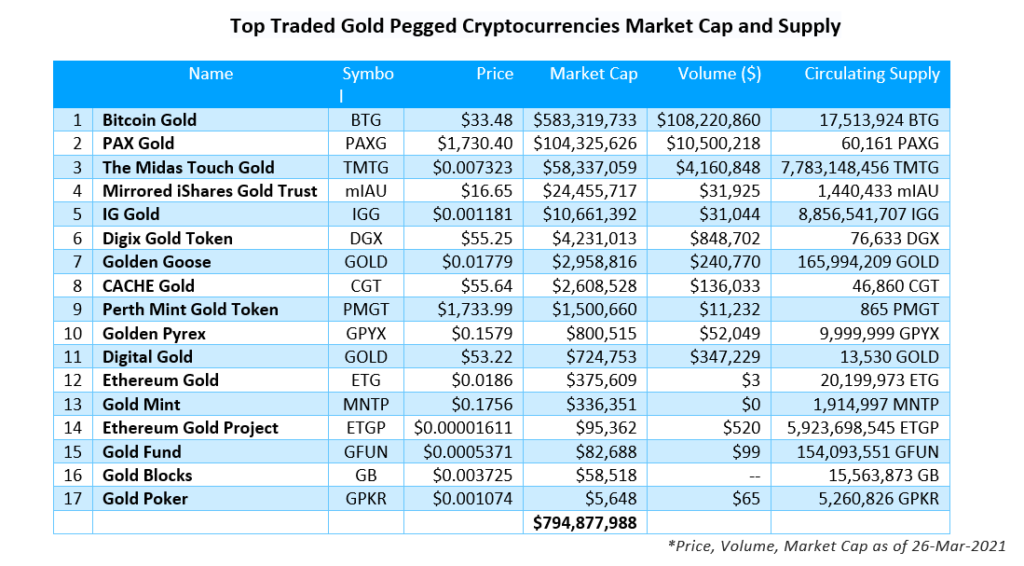

As we can see from the below table, the market cap of the top traded Gold-Pegged Cryptocurrencies is around $794 Million, which is around 0.05% of the total Cryptocurrency Market cap of $1.73 trillion. This infers that there is Gold-backed Cryptocurrency Market is very small compared to the overall Cryptocurrency market. A lot of more participation and awareness is required for this market to grow.

One of the biggest concerns prospective investors have with the cryptocurrency world is volatility. Big price swings with virtual currencies mean great profits and massive losses can be reaped in minutes.

In India, despite government threats of a ban, transaction volumes are swelling and 8 million investors now hold 100 billion rupees ($1.4 billion) in total crypto-investments, according to industry estimates. No official data is available.

You may also like to read: Gold stands tall amid Bitcoin’s goofiness

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advices. The author, Directors, other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above mentioned opinions are based on the information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors and other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or an implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purpose and are not to be construed as investment advices.

|

1 Comment. Leave new

Cryptocurrency scams and hacks