Gold surged around 1% last week, the fourth straight weekly gain after Federal Reserve Chair Jerome Powell told Congress the central bank is committed to its ultra-easy stance despite

rising inflation. As per the latest data of June 2021, US CPI was recorded at 5.4% and US Core CPI was 4.5% which is at a 13-year high level.

With the US central bank projecting 2% core PCE inflation in 2022 and 2.1% in 2023 and considering that the US economy will need to create some 380,000 jobs per month for the next two years to reach full employment, there seems to be plenty of time to keep the zero-bound policy alive (with negative real rates), before any inflation target overshoot forces a tightening.

Fears over inflation, and whether it will be transitory or not, continue to cast a dark cloud over markets and should be supportive for gold in the short term. And expectations regarding monetary policy are key. Markets are closely monitoring economic growth metrics, as well as central bank statements, searching for clues as to the likely timing of the tapering of asset purchases. For now, it seems that accommodative policies will remain in place, creating support for gold investment at least till 2021.

Reasons for higher inflation might be:

- The rise in Crude Oil prices

- Easy Monetary Policy and Money Printing by Central banks

- Rising FED balance sheet and National Debt levels

- Problems with the supply chains and lower base effect due to pandemic

Because higher inflation leads to lower interest rates, currency depreciation, higher unemployment, etc. Gold is often hailed as a hedge against inflation—increasing in value as the purchasing power of the dollar declines. As far as inflation remains elevated, US FED will remain accommodative in Monetary stimulus and low-interest rates, which is very supportive for Gold and helps in beating inflation.

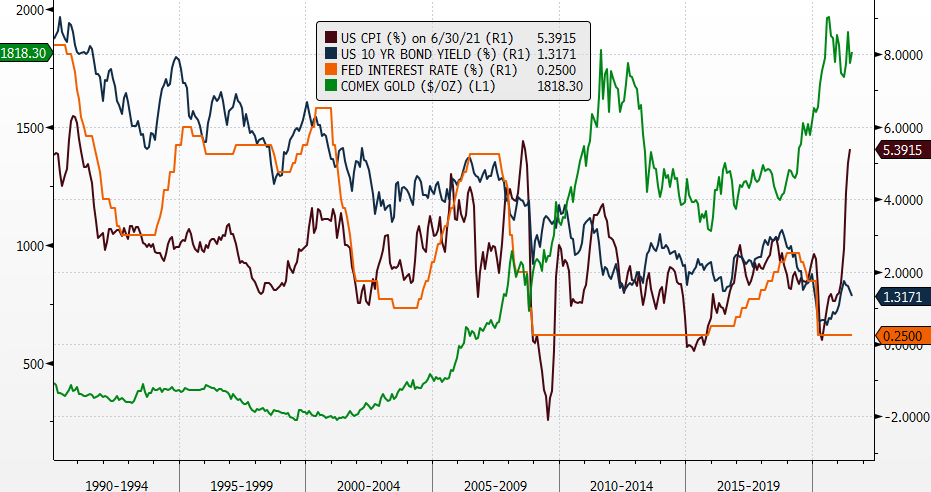

Relationship between Gold, Interest Rate, Inflation, 10 Yr Bond Yield

Source: Bloomberg

In theory, when inflation goes up, the price of bonds falls and the yields on those bonds rise. However, what is happening now is somewhat perplexing as bond yields have been falling even as inflation is rising. In 2020, Gold acted as a safe haven in times of crisis and uncertainty, while in 2021, Gold is acting as a hedge against inflation. As a result, gold appears to be appealing to us. Gold is likely to trade with bullish bias with support at $1800 in the foreseeable future, and it can touch $1900 once more. In domestic markets, the range would be Rs 47400 to Rs 49000 for the next few days.