The recovery from the pandemic has raised the potential of central banks scaling back their stimulus, therefore gold has lost approximately 7.9% this year. The demand for the haven asset has been dragged down by rising US stocks amid economic confidence and the launch of vaccinations. Investors should be aware that, unless the dollar index changes significantly, gold prices will likely be driven more by risk appetite in the future.

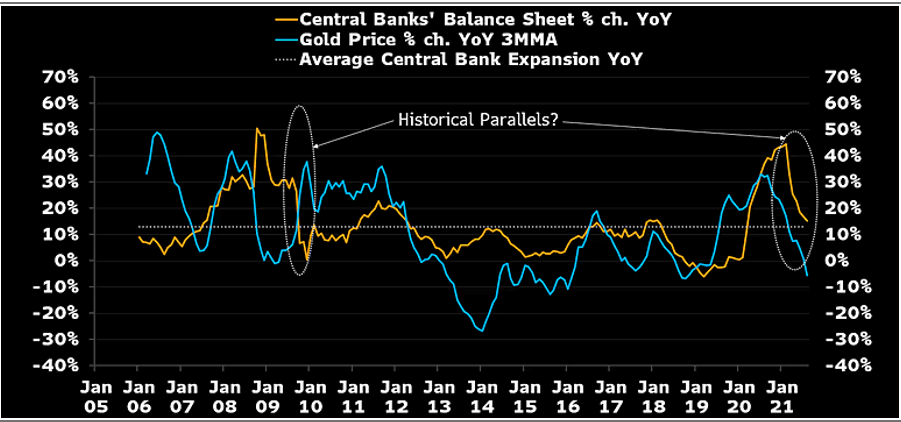

Central banks’ asset purchases have been extended through 2021, but year-over-year growth has slowed substantially, a development that the gold price had foreshadowed to some extent. Adjustments to normalization (as witnessed in 2009-10) haven’t been as difficult for the metal as a sustained period of sub-13 percent balance-sheet expansion has been in the past. We think that’s a good analogy.

Central Bank Balance Sheet Momentum vs Gold

Source: Bloomberg

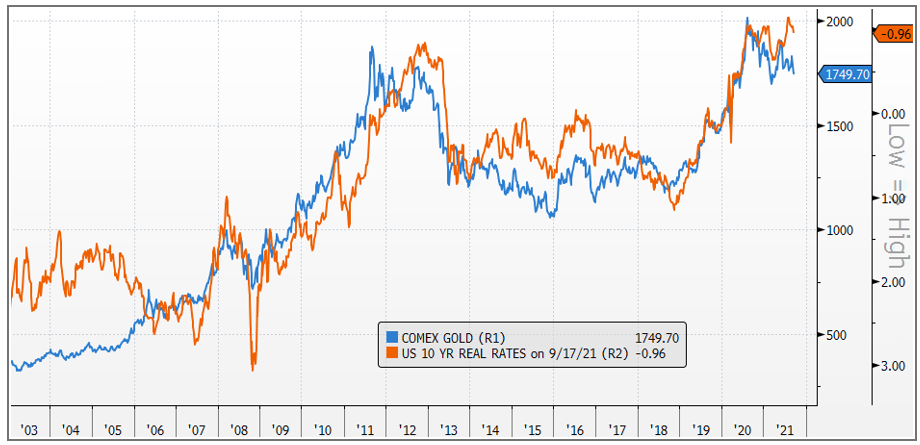

After peaking at minus 1.18 percent at the end of July, US negative real yields for quasi-currency gold have become marginally bearish. Gold, on the other hand, has underperformed real yields since its peak in August 2020, with the metal nearly completely disconnected since the beginning of June. Gold pre-empted the strong spike in real rates after the Fed began to trim asset purchases in late 2012 and early 2013. A real interest rate is an interest rate that has been adjusted for inflation to represent the borrower’s real cost of funds and the lender’s or investor’s real yield. Despite the fact that the FED may have paused due to disappointing U.S. job data, we expect asset purchases will be tapered soon. Inflation expectations appear to have declined as well, with the 10-year breakeven steady at 2.35 percent after spiking at 2.56 percent in May.

US Real rates (yields inverted) with COMEX Gold

Source: Bloomberg

Gold’s next move, though, will be determined by how quickly central banks reduce bond purchases and how long balance-sheet growth remains below the 13 percent mark. Since February 2020, the top four central banks (the Federal Reserve, the European Central Bank, the People’s Bank of China, and the Bank of Japan) have expanded their balance sheets by more than $10.5 trillion, which may keep gold from dropping too far, even if momentum slows.

Also, Read: How will $1.9 Trillion Stimulus Package Impact Gold Prices?