Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) –Rebound –– Gold is trading in a channel with lower highs and lower lows. Next target level it could touch is 52000. While Silver has retraced almost 23.6% from its lows, next level to watch for is 50% retracement 63700.

Long-term View (3-4months) -Positive – Any dips towards 50000 and 60000 should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively

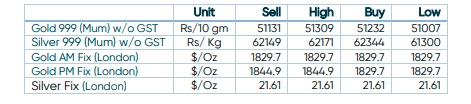

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Precious Metals gathering momentum again

- International News – Gold extended its upward momentum in last two days, briefly testing the $1,870 region for the first time in more than three weeks on a weaker dollar and safe-haven demand stemming from persistent geopolitical tensions and lingering concerns about slowing global growth and inflation.

- Demand and Supply – US mint sold 147,000 ounces of American Gold Eagles in varying denominations totaling 200,500 coins in May, a 67% increase from March

- Economic Data–The ADP report showed that US companies added the fewest number of jobs since the pandemic recovery began, suggesting the Fed could be less hawkish. Now investors are awaiting US nonfarm payrolls for clues about the economy’s health and the outlook for monetary policy.

- Domestic News– RBI has recently come out with the Sovereign Gold Bond Scheme Calendar for premature redemption from April to September 2022.