gold and silver – kya lagta hai

short-term view (up to 1 week) – Weakness– Gold has broken support at downtrend channel again, while Silver is continuously trading below its downtrend line from last 5 months

long-term view (3-4months) – positive – – – Any dips towards 50000 and 52000 should be used as buying opportunities for the target of 55000 and 60000 for Gold and Silver respectively by year end.

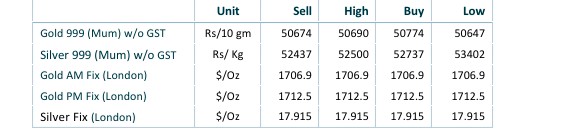

spot prices

spot gold daily price chart

spot silver daily price chart

Important news and triggers

Precious Metals witness short-covering rally

- International news – Precious Metals is kind of seeing a relief-short covering rally. U.S. jobs data came mostly in line with expectations. Nonfarm payrolls increased by 315,000 jobs last month. The market is deeming it as a goldilocks number as it doesn’t suggest weakness, but is not too strong to prompt an even more aggressive FED.

- Demand and Supply – – As long as gold is priced in the U.S. dollar, it’s critical to keep the latter in mind. And last week, something epic happened in the forex market. Namely, the EUR/USD closed the week below the all-important 1 level. For the first time in almost two decades!

- Economic data – – – It’s getting much clearer that central banks are going to be aggressive with tightening due to unprecedented inflationary pressure, which is not good for gold