Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rebound –If bullion doesn’t hold support at $1,690, it could retest $1,660 level. Market will be now be focused on key inflation data next week, as well as the Fed minutes. Long-term View (3-4months) – Positive – Any dips towards 49000 and 52000 should be used as buying opportunities for the target of 52000 and 60000 for Gold and Silver respectively in long-term.

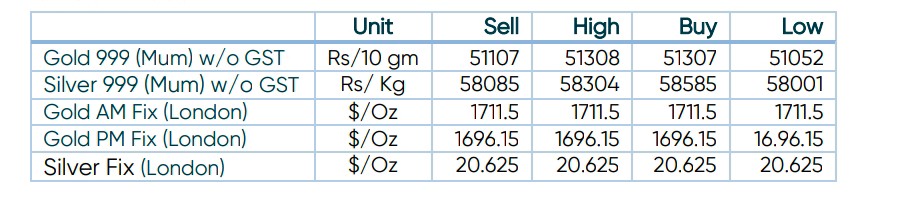

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – Bullion prices fall, after a better-than-expected U.S. jobs report cemented expectations, the Federal Reserve would implement steep interest rate hikes and lifted the dollar and bond yields.

- Economic Data – Data showed U.S. employers hired more workers than expected in September, while the unemployment rate dropped to 3.5%. The market is looking at the stronger-than-expected payrolls report as further impetus for the Fed to raise yet another 75 bps at the early November meeting.

- Interest Rate – Fed fund futures are now pricing in a 92% chance of a 75-basis-point (bps) rate hike by the U.S. central bank at its policy meeting next month after a strong labour market report.

Disclaimer