The broad-based selling pressure surrounding the dollar in the early half of the week helped gold hit a new multi-week high of $1675 on Wednesday. Gold reversed its trend and concluded the week in negative territory around $1650, despite optimistic macroeconomic data releases from the US helping the currency regain its strength. According to the CME Group’s FedWatch Tool, markets are currently pricing in a 51.5 percent possibility of the Fed raising its policy rate by 125 basis points by the end of 2022.

Investors are holding their breath, trying to predict what the Fed’s rate hike cycle will imply for the US economy and financial system. The primary question is: How high will US interest rates rise? And when will the Fed drop interest rates again? The Fed is widely expected by financial sector investors to be serious about controlling inflation. As a result, the federal funds rate is largely predicted to rise to 4.5 percent or perhaps 5% in the following months.

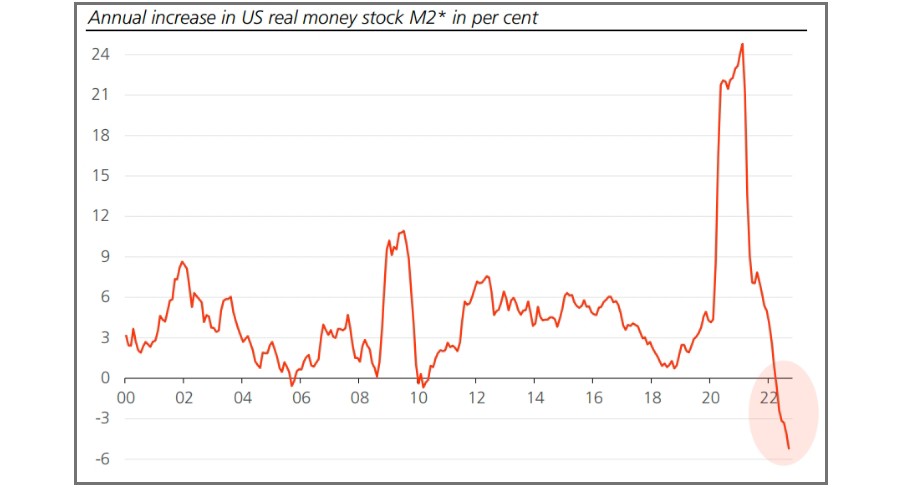

The chart above shows that the annual increase of the real money stock M2 in the US has turned negative. In fact, it has never been this negative in the period under review, not even during the global financial crisis of 2008/2009. It puts a massive strain on economic expansion, and it may also cause stress for the financial system. Because a contraction of the real money stock, accompanied by higher interest rates, will make it much harder for borrowers to service their debt, especially when the economy goes into recession.

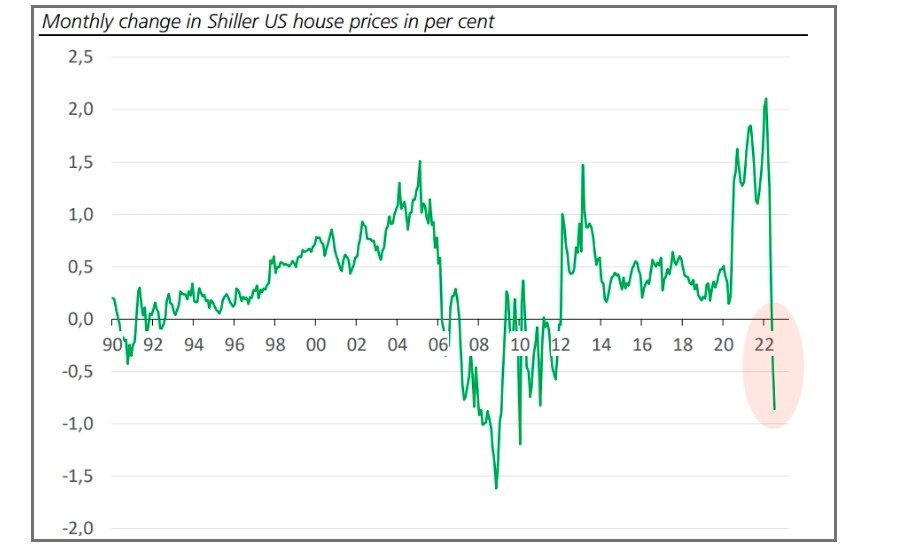

The price development in the US home market is another clue that monetary conditions are tightening dramatically. The figure below depicts the Shiller house price index’s monthly fluctuations. House prices in the United States fell 0.9% month on month in August 2022, following a 0.5% month on month drop in July. If the price decrease worsens into a full-fledged housing market meltdown, as additional monetary policy tightening is expected to do, the economic and financial system might become highly volatile.

The market positioning shows that the dollar has more downside room if investors believe the Fed will boost rates by 50 basis points in December. In that situation, Gold is anticipated to gain bullish momentum as US yields decrease. Furthermore, a risk rally might be initiated as markets begin to price in peak FED hawkishness, adding weight to the USD.