Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Positive – – Gold and Silver prices are seeing rebound as MACD Indicator has reversed in 4-Hourly chart and giving buy signal.

Long-term View (3-4months) – Positive – –Any dips towards 51000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively in long-term.

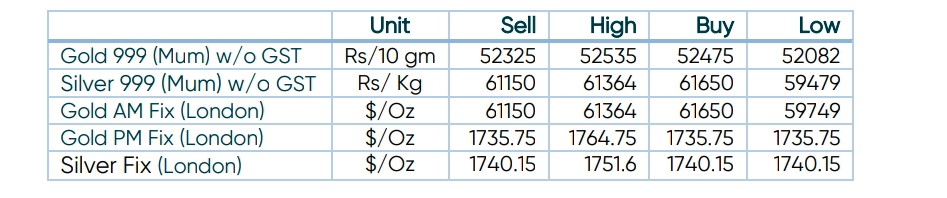

SPOT Prices

SPOT Gold 4 Hourly Price Chart

SPOT Silver 4 Hourly Price Chart

Important News and Triggers

International News – Gold has steadied following a four-day correction that was triggered by the yellow metals inability to break resistance at $1788 per ounce.That failure triggered long liquidation from funds who had just added the most length in COMEX gold futures since June 2019. That reduction is now showing signs of having run its course with buying emerging at the former resistance level, now support at $1735.

Currency and Bond market – Since the November 3 low at $1615, gold has bounced by around 7% while the broad Bloomberg Dollar index trades down by close to 5%. In addition, the recovery in gold has been supported by a 30 bps drop in US ten-year real yields and a key part of the US yield curve inverting the most since the early 1980’s, thereby signaling an increased risk of a recession hitting the US economy next year.