Fundamental News and Triggers

• This week, gold experienced phenomenal gains as several Federal Reserve officials stated that the FED is unlikely to raise interest rates any more due to recent decreases in inflation and that additional

softening of inflation may lead to a rate cut in early 2024.

• Expectations of rate reduction in 2024 have driven recent stock market rallies, as the Fed indicates a

cautious attitude to future rate hikes.

• A speech that Fed Chair Jerome Powell would give on Friday was also a topic of discussion. It would

be his last statement before the two-week lockout period that precedes the Fed meeting in December. At its final meeting of the year, the central bank is anticipated to maintain its current rate

of 0%.

Technical Triggers

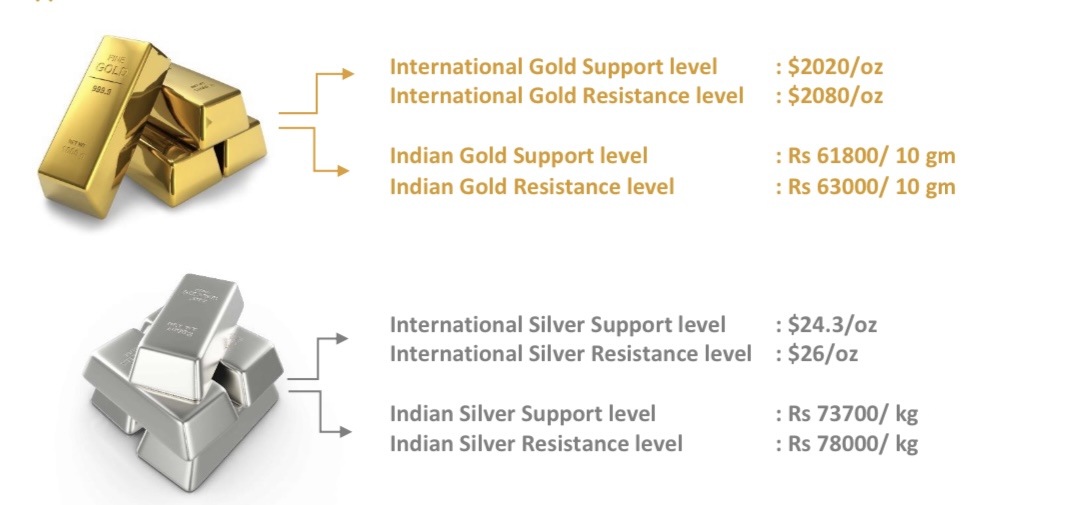

• Gold prices are consolidating around the resistance level of $2045 (Rs 62300).Once the prices sustain above these levels, the next target is $2080 (Rs 63000).

• Silver after clearing the resistance of $25 (Rs73500), the next level to watch for is $26 (Rs 78000).

Support and Resistance

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advices. The author, Directors, other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on the information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors and other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or an implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purpose and are not to be construed as investment advices.