Fundamental News and Triggers

- As the Fed kept its fund’s rate constant for the sixth consecutive meeting, citing a strong labour market and a lack of success in fighting inflation, gold prices fell below $2300. Additionally, the central bank has said that it would not lower borrowing costs until it is more certain that inflation is gradually moving toward its target.

- The positive US economic data and persistent inflation have caused traders to lower their expectations for this year’s Fed rate cut.

- Concurrently, the World Gold Council declared that the first quarter saw a 3% increase in global gold demand to 1,238 metric tons, marking the strongest start to a year since 2016.

- The need for safe havens was also waning, particularly in light of recent rumours that Israel and Hamas were holding fresh peace negotiations. This increased the vulnerability of gold to rate-driven threat

Technical Triggers

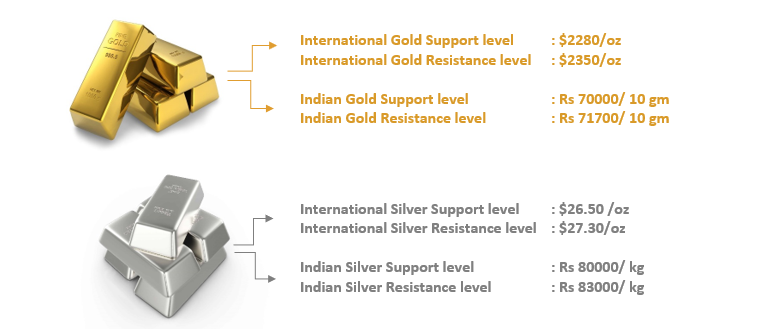

- Gold prices have strong support around the $2280 zone, if prices sustain below this, it can fall to $2220.

- Silver has strong support at $26.5, if prices sustain below this, it can fall to $26.

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.