Fundamental News and Triggers

- Auspicious day “Akshaya Tritiya” is here again to buy gold. Silver is also getting a boost from the gold run-up and prices trading at near record high levels of Rs 85000. Further gains are expected in Gold and Silver, so the best way to start investing in precious metals is to start SIP on this auspicious day.

- Gold’s value has increased significantly as a result of recent global events, which is consistent with its reputation as a safe-haven asset and its attraction during low interest rate times.

- Gold’s attractiveness as a protective investment is further enhanced by geopolitical concerns, such as an extended standstill in ceasefire negotiations between Israel and Hamas and the rising crises in places like Ukraine.

Technical Triggers

- For more than two weeks, the price of gold has been stabilizing and ranging between $2300 and $2360. A rise over $2360 would open the door for a retest of previous highs above $2400.

- The next obstacle for the Silver Bulls is $29, where a resistance zone has developed. If prices sustain above this level, the next target is $30.

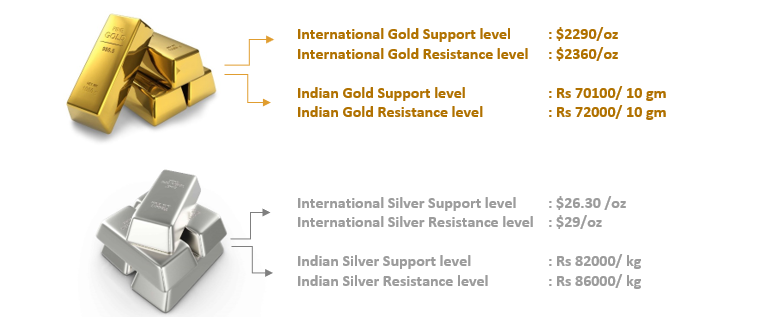

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.