Fundamental News and Triggers

- The gold price is falling as the Federal Reserve’s aggressive outlook continues. The Fed’s September rate cuts remain on the table, capping gains for the Dollar Index.

- Federal Reserve policymakers continue to advocate for keeping interest rates higher for longer, which raises US Treasury bond yields and limits the upside for the gold price.

- Concerns about an all-out conflict between Israel and Lebanon remain alive in the aftermath of mounting tensions sparked by Hezbollah provocations, limiting the downside for the safe-haven precious metal.

Technical Triggers

- Gold is trading in the range of Rs 71000 to Rs 71800 with a descending trend channel from the past few days, prices need to give a breakout on either side for a new directional trend.

- Silver has formed Double Top formation around $32.5 on daily charts time frame. As prices have closed below the important support of $29.5, the Double top formation target is $28.50 and $26.50.

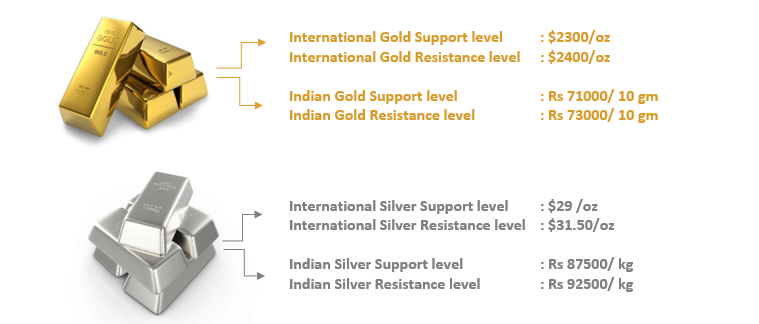

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.