Fundamental News and Triggers

- The gold price continues to soar above $2500 per troy ounce, aided by rising geopolitical concerns in the Middle East. Last week, US Federal Reserve Chair Jerome Powell’s address at the Jackson Hole symposium signalled the “time has come” to cut interest rates, which supports the precious metal.

- Gold ETF holdings surged by 15 tonnes last week, reaching their highest level in six months. Speculative interest is very intense. The net long position of speculative investors increased to roughly 193,000 contracts in the week ending August 20th, while gold reached an all-time high, its greatest level in over four and a half years.

- The attention will shift to the preliminary US GDP Q2 annualized US PCE data, which will be published on Thursday and Friday, respectively for further cues.

Technical Triggers

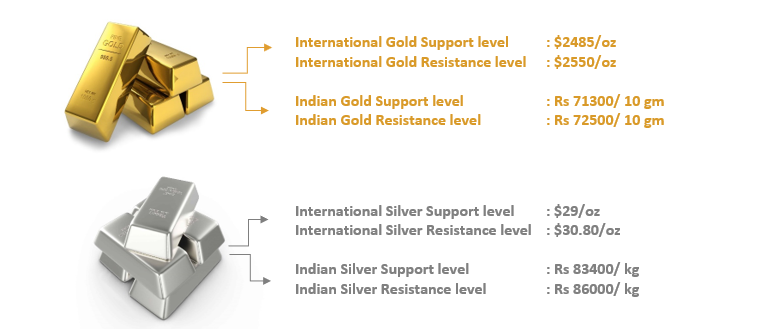

- Gold buyers must reclaim the record high of $2532 (Rs 72270) before confronting the next important hurdle at $2550 (Rs 72500). Acceptance over the latter might attempt the $2600 (Rs 75000) round barrier en route to the triangle goal of $2660 (Rs 76500).

- On the other hand, the initial demand level for Gold buyers is predicted below $2500, below which Friday’s low of $2485 (Rs 71300) will be tested. A sustained breach of the latter might expose the downside to the previously indicated triangle resistance-turned-support at $2468 (Rs 70900).

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.