By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

Global Factors Impacting the Gold Rally

Gold has been the best-performing asset class in 2024, rising around 30% in international markets and 22% in domestic markets with prices surpassing the $2700/oz (~ Rs 76400) mark. The global central banks’ ongoing gold purchases, the US Federal Reserve’s rate cuts, the geopolitical unpredictability of the world’s markets, the slowdown in the Chinese economy, and the recent monetary stimulus measures taken by the Chinese central banks are all responsible for the strong performance.

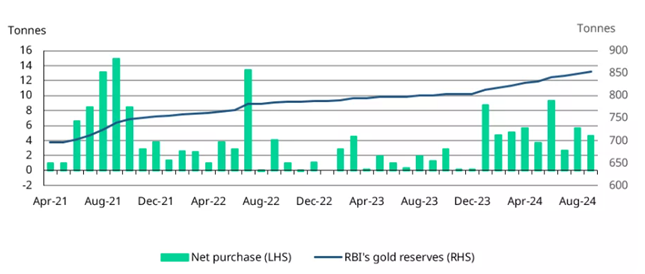

- Central Bank Buying

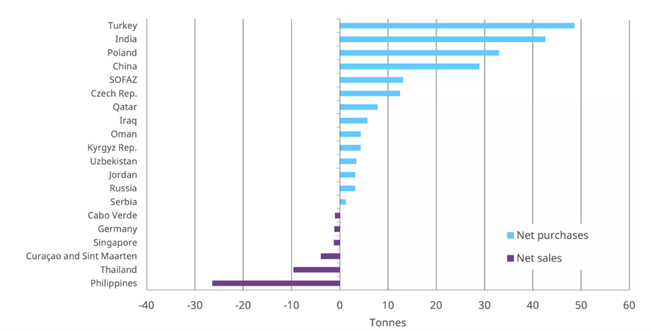

This year’s central bank gold demand is probably being influenced by the gold price increase, but the long-term pattern of net purchasing is still in place. Total gold holdings added by central banks around the world from January to July is around 520 tonnes. Turkey, India and Poland have been the top buyers, while the Philippines and Thailand are the net sellers.

2024 Central Bank Gold purchases/sales

- FED rate cut cycle

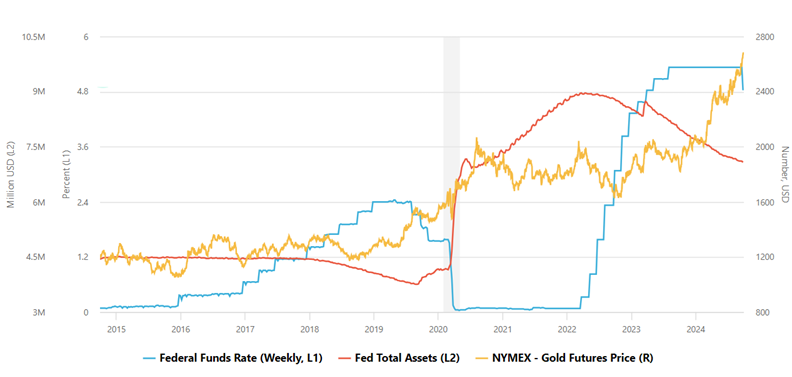

Even if inflation is still high, gold is still in a favourable position as the Federal Reserve cuts interest rates to support a contracting labour market. After a 50 bps rate cut and a warning that rates may drop to 3% by 2026. It’s evident that the Fed is relaxing, which is good news for yellow metal. With central banks all over the globe starting to lower interest rates, gold is still the primary hedge against currency devaluation on a worldwide scale.

Fed Interest Rate and Total Assets

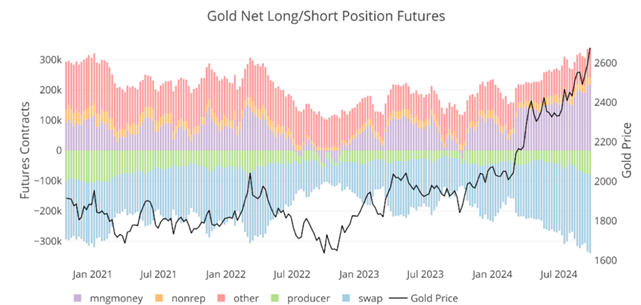

- Gold CFTC positioning

Due to the ongoing rate-cut cycle by the Federal Reserve, geopolitical worries in the Middle East, and expectations of increased festival demand in India, investors are still building long positions in gold. U.S. traders have lately entered the speculative phase headed by China, with futures long holdings at a nearly four-year high (315,000 contracts), producing a market that is mostly unaffected by normal drivers.

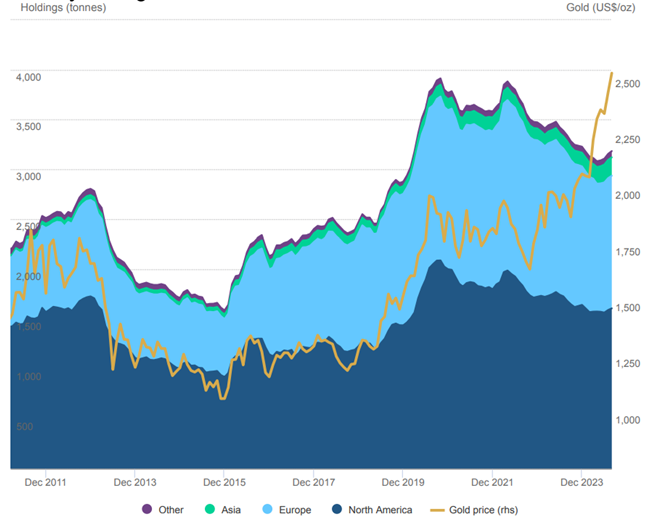

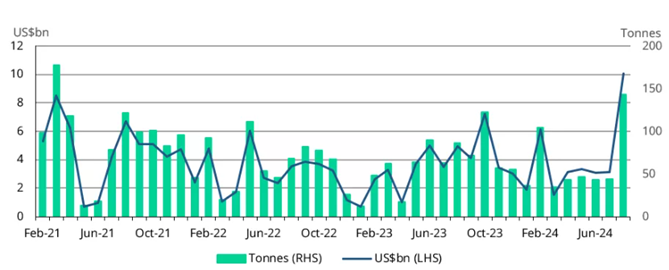

- ETF Holdings

Four months in a row, there have been inflows into global gold ETFs: all regions had positive flows, with Western funds leading the way. The y-t-d losses for global gold ETFs further decreased to $1bn as a result of nonstop inflows between May and August. Additionally, the 2024 holdings reduction has been reduced to 44t. In the meantime, during the first eight months of 2024, the total AUM increased by 20%. Asia has seen the most inflows this year ($3.5 billion), while the leading outflows are from North America (-$1.5 billion) and Europe (-$3.4 billion)

ETF Holdings picking up in 2024

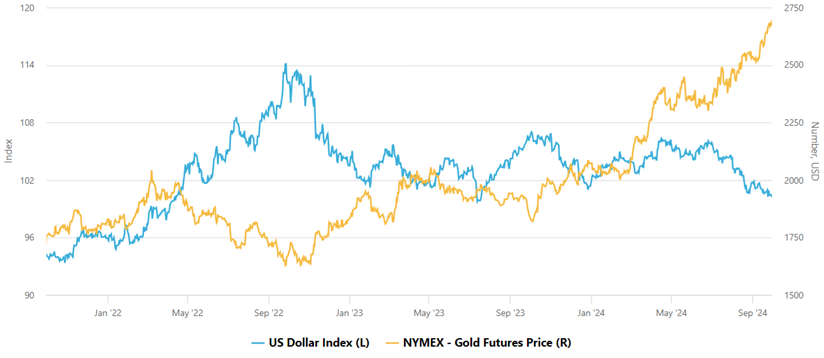

- Dollar index

The Dollar Index has slipped below the highly crucial psychological milestone of the 100 mark as the US Dollar’s role as the major global reserve currency is being threatened. The combination of better risk sentiment and lowered Fed rate expectations is fundamentally unfavourable. Since gold doesn’t generate interest, cuts in interest rates contribute to a declining value of the US dollar, which in turn makes the non-yielding metal more appealing. The dollar index’s negative relationship with gold keeps the yellow metal maintained at high levels.

- Gold Silver ratio

The gold-silver ratio dropped to its lowest levels since July during the last week of September, when gold started to approach $2700 and silver momentarily overtook a 10-year high of over $33. At this point, the gold-to-silver ratio is 84 to 1. The beginning of a silver rally that would see white metal surpass its more costly counterpart would be confirmed by a sustained decline in the gold-silver ratio.

Gold Silver Ratio

Domestic Factors Supporting Gold

- RBI Gold reserves

The Reserve Bank of India’s appetite for gold remains high, as indicated by its recent acquisitions. Over the first eight months of the year, the RBI has acquired a total of 50 tonnes of gold, with acquisitions in each month. Up from 7.5% a year ago, the RBI’s gold reserves have now reached a record 853.6 tonnes or 9% of its total foreign reserves.

- India Gold Imports

The Union Budget’s announcement of the reduction in import duties and the modifications to the long-term capital gains for gold ETFs has contributed to the rise in gold imports into India. Between January and August, gold imports increased by 30% year over year to almost 485 tons, valued at US$32 billion.

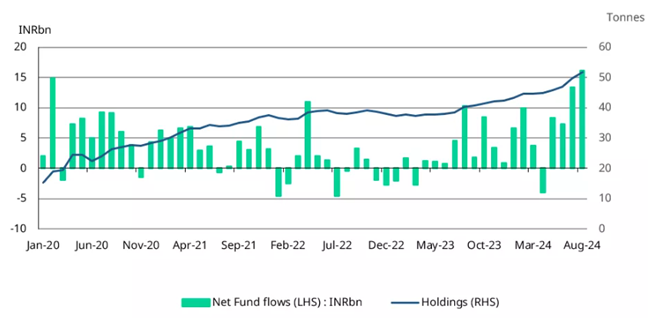

- Gold ETF Holdings

Investor interest in Indian gold ETF has surged since the end of July. According to AMFI data, net inflows into Indian gold ETFs have reached Rs 61 billion (~$735 million) thus far in 2024, a considerable rise of over Rs 15 billion during the same period in the previous year. Together, these funds have added 9.5tn of gold this year, increasing their total holdings to 51.8tn, a 29% year-over-year rise.

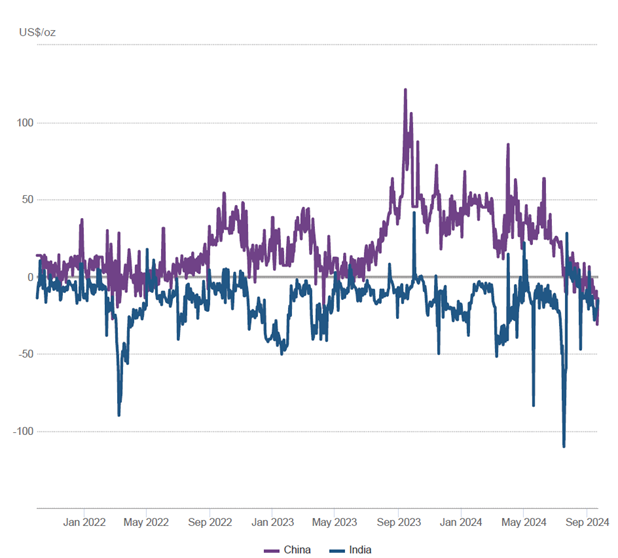

- Gold Premium/Discount

The gap between domestic and international gold prices has narrowed as a result of rising global prices and increased supply from increased imports. Domestic gold prices have been trading either at a modest discount to or in line with international prices in recent weeks, despite the normalizing but still robust demand.

Outlook for the second half of 2024-25

Over the past two years, gold prices have been underpinned by strong physical demand from China and central banks. However, investor flow, and specifically retail-focused ETF building, remains crucial for a further sustained gain during the upcoming Fed cutting cycle. Initiating its easing cycle on September 18, the Fed projected 50 basis points of rate reduction by year’s end and a full percentage point of decreases the following year.

During times of global instability and low interest rates, gold is typically favored as an investment. The U.S. presidential election on November 5th may possibly lead to a further increase in gold prices, as investors may seek safe-haven assets due to possible volatility in the markets.

Overall, with continued global economic uncertainty, gold is expected to retain its appeal as a hedge against inflation and market volatility. Investors may adopt a “buy on dips” strategy as the metal is likely to see periodic fluctuations, but the long-term outlook remains bullish through for next 5-6 months and prices are expected to touch $3000 (~Rs 84000).

Having said that, currently gold prices are in the overbought zone, so we might see a consolidation phase and a retracement with support at $2575 (~Rs 73000) and resistance being the next psychological level of $2750 (~Rs 78000) in the next one month.

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice