By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

Gold and Silver were dumped by 2.5% and 4% last week respectively as several key events caused a lot of price volatility. US Election and announcement of Trump’s Victory, then US FED and BOE cutting interest rate by 25 bps.

Gold prices reached a new high of $2801 on Diwali, but profit-taking followed due to anxiety surrounding the US election. President-elect Trump’s triumph triggered increases in stocks and bond rates across the curve, as well as sales of precious metal packs. Although the president’s oath ceremony is two months away, the market expects Trump to take a tougher posture on trade, widening his targets beyond China. He may contemplate tax cuts or even an increase in spending to boost the economy, which might result in a greater budget deficit, as happened during his first term. This will bring its own set of issues, given the US public debt is substantially higher now than it was in 2018.

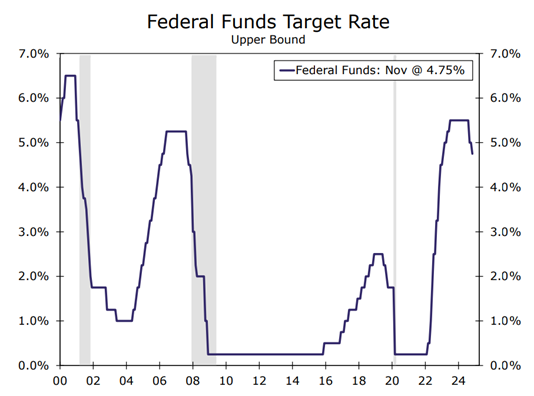

Even after the 2024 presidential election, there remains a great deal of uncertainty about the economy’s direction and Fed policy. Tariffs and a tax policy appear to be on the agenda in the next administration, which could lead to higher inflation and thus higher rates. As a result, the market expects a slower pace of future interest rate decreases, which has weighed on the precious metals pack.

Furthermore, precious metals received support when the FOMC decreased the federal funds target range by 25 basis points to 4.50%-4.75%. Following the Fed’s widely anticipated quarter-point interest rate cut earlier this week, Chair Jerome Powell recognized that recent inflation data had exceeded expectations. However, he also noted that downside risks exist, implying that the Fed may need to modify the pace of rate decreases.

This week’s US economic calendar will have an impact on Gold’s direction. Traders will pay close attention to Federal Reserve officials’ comments, as well as significant data releases on consumer and producer inflation and retail sales.

Gold Weekly Chart

As discussed in the last Weekly Blog “Will Gold Touch $2800 (~Rs 80,000) Before Diwali”, gold indeed touched a high of $2801 on Diwali on 31st Oct and achieved that target. Last week, we saw prices retracing almost Rs 3000/10 gm on Trump Trade. Profit booking and retracement will likely to continue in Gold for the next few days up to Rs 74000-Rs 74500 levels.

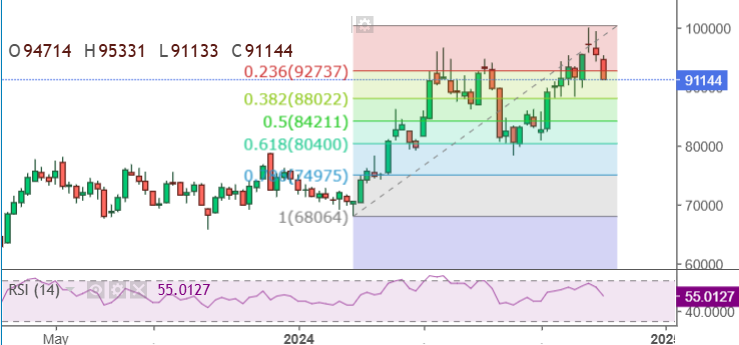

Silver Weekly Chart

Gold and Silver’s long-term trend is bullish, but both metals are likely to witness profit booking this month, as they were in the overbought zone for a long time. Silver has retraced almost 10% from its high of Rs 100,000/kg. More profit booking and retracement are expected in Silver up to Rs 88000/kg in the coming days.

For those who are waiting to buy gold for investment, these dips in November should be used as an opportunity as prices will continue their uptrend in 2025.

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.