Fundamental News and Triggers

- Gold prices surged to a record high of $2968 (~Rs 86300) as investors flocked to the safe-haven asset after he imposed new 25% tariffs on steel and aluminium imports, inflaming inflation and a potential trade war.

- The risk of a global trade war is putting pressure on trading in physical bullion and driving financial markets to get exposure to gold as part of what can be loosely described as a de-dollarization theme.

- Additionally, worries that Trump’s protectionist policies would reignite inflation in the US prove to be another factor that benefits the precious metal’s status as a hedge against rising prices.

Technical Triggers

- Gold has crossed another psychological level of $2950 (~Rs 86000), and now we may see strength towards a very important psychological level of $3000 (~Rs 87500).

- Silver is still facing resistance at $33 (~Rs 96000). If prices sustain above this level, we are likely to see a 5% up move for the target $35 (~Rs 101,000).

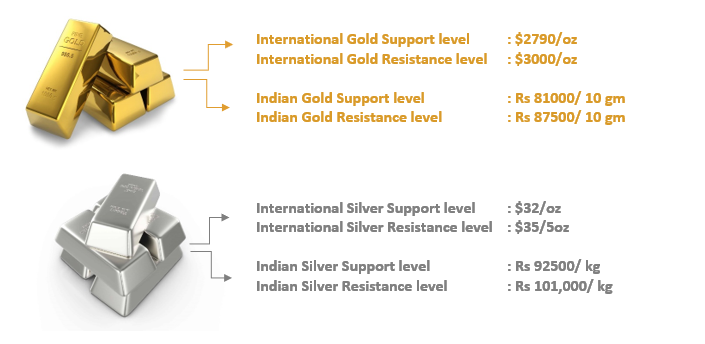

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.