Fundamental News and Triggers

- Before the US inflation report was released, gold prices dropped $80, but prices swiftly recovered. According to a report released yesterday by the US Bureau of Labor Statistics, the headline US CPI increased by 0.5% in January, the highest since August 2023, and the annual rate increased from 2.9% in December to 3%.

- The fact that gold has recovered from its intraday lows shows that investors still view the safe-haven asset as their main weapon against ongoing inflationary pressures and the Federal Reserve’s shift to a much more hawkish monetary policy. Despite short-term volatility, gold’s price behaviour indicates that the commodity is still well-supported.

- However, the US dollar is still unable to draw in any significant buyers and is hovering around the lower end of its weekly range as of Wednesday, further lending support to the yellow metal.

Technical Triggers

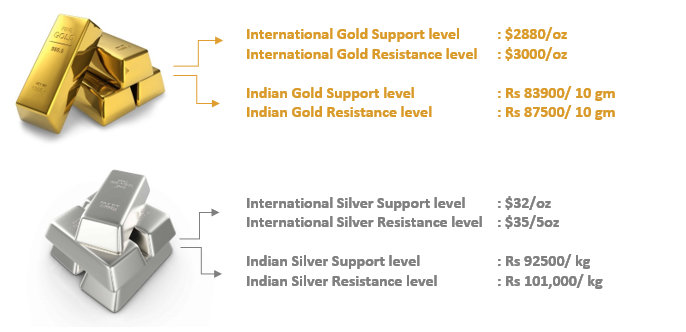

- Gold Apr Futures fell below the $2907 (~Rs 84700) support level and retraced towards $2880 (~Rs 83900) but prices didn’t sustain at lower levels and quickly bounced back after Inflation data. Gold prices have sustained above $2935 resistance today, so it is likely to maintain its upward momentum of $3000 (~Rs 87500) in a few days.

- Silver is still facing resistance at $33 (~Rs 96000). If prices remain above this level, we are likely to see a 5% upward for the target $35 (~Rs 101,000).

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.