Fundamental News and Triggers

- Gold consolidates around record-high prices amid safe-haven flows fueled by worries about US President Donald Trump’s tariff proposals.

- US President Donald Trump stated that tariffs on imports from Canada and Mexico are “on time and schedule” and that reciprocal tariffs on other nations will also proceed as planned. This increases the possibility of trade tensions escalating further and feeds worries about their effects on the global economy, which could continue to support the safe-haven precious metal.

- The Federal Reserve’s two-quarter percentage point rate cut this year was confirmed by the latest worse US macro data, which may also help to minimize losses for the non-yielding metal.

- The largest gold-backed ETF in the world, SPDR Gold Trust, also backed the precious metal, stated that its holdings increased to 904.38 tonnes on Friday, the highest level since August 2023.

Technical Triggers

- Gold Apr Futures traded at a new record high of $2974 (~Rs 83515) yesterday, having cleared the resistance of $2965 (~Rs 86300) on the continued uncertain environment of tariffs.

- Gold prices are moving towards the next psychological resistance, targeting $3000 (~Rs 87200-300) and beyond.

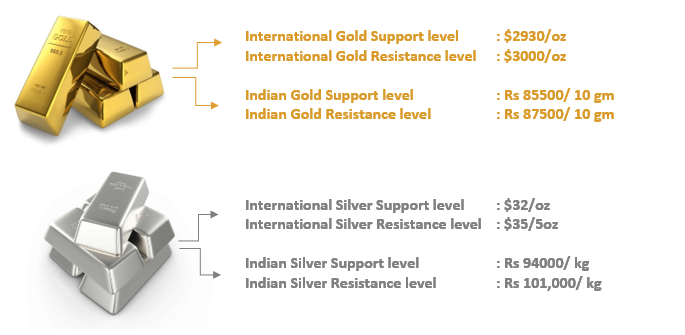

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.