Fundamental News and Triggers

- Gold maintains its winning streak above $3025 (~Rs 88500) as Trump’s tariffs are projected to exacerbate inflation and economic turmoil. Trump said he would hold Iran accountable for any strikes carried out by the Houthi group it supports in Yemen, as his administration escalated the largest US military operation in the Middle East since Trump came to the White House.

- Central banks’ accumulation of gold reserves, inflation concerns, and rising demand after the pandemic have contributed to the surge in gold prices.

- The Fed is expected to maintain its benchmark interest rate in the 4.25%-4.50% range after its two-day policy meeting on Wednesday.

Technical Triggers

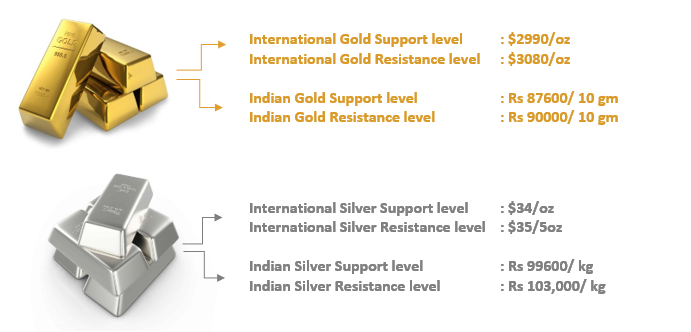

- Gold Apr Futures after achieving the $3000 (~Rs 88000) milestone, now is expected to extend this run up towards $3035 (~Rs 88800) and $3080 (~Rs 90000) in the coming weeks. After that, we can see some retracement and profit-booking, which can extend down to $2800 and $2700 maximum.

- While Silver May Futures has also climbed above $34(~Rs 100,000) on strong demand, the next resistance for the prices is $35(~Rs 103,000).

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.