Fundamental News and Triggers

- Gold prices have surged to an all-time high today, fueled by a lower dollar, trade war tensions, and concerns about global economic growth as a result of US President Donald Trump’s tariff plans, which prompted safe-haven inflows.

- On Tuesday, President Trump ordered a probe into potential duties on all vital mineral imports, signaling a tougher stance on trade and potentially influencing relations with important suppliers, notably China.

- This development somewhat negates the market relief provided by the recent exclusion of certain tech products from reciprocal tariffs, as well as the suggestion of possible exemptions for auto parts.

- Increasing chances of a deeper recession, another turn in the geopolitical landscape, disruptions in global supply chains, and fears of increasing inflation coupled with a changing rate outlook suggest that gold will maintain its strong position in the near future.

Technical Triggers

- As the gold active Jun contract has sustained above $3245, is expected to continue its bullish momentum to touch $3300 (~Rs 95000) and $3320 (~Rs 95500) going ahead.

- Silver after achieving the target of $32 (~Rs 94000), we are likely to see this rally extending further towards $33 (Rs 95500) and beyond this week.

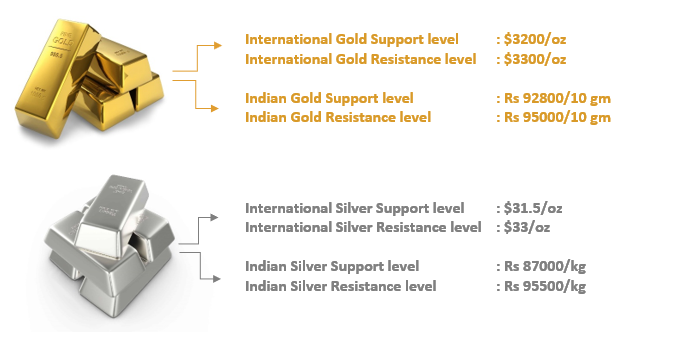

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.