Fundamental News and Triggers

- The gold price reached an all-time high of $3371 (~Rs 95894) as the tariff war between the world’s largest powerhouses escalated further. US President Donald Trump has ordered his team to investigate potential new tariffs on all imports of critical minerals, to reduce their dependency on China.

- In response to Donald Trump’s heavy reciprocal tariffs on rare minerals, Beijing has set severe curbs on their exports to the United States.

- Investors are questioning the integrity of the US dollar in light of Trump’s unexpected decision on international policies. The US dollar has been falling sharply as investors fear that the US-China trade war will be more severe for the US economy than for the rest of the globe.

- Gold is also receiving support after Fed Chair Powell stated that a weaker economy and high inflation could conflict with the central bank’s two aims, resulting in a stagflationary scenario.

Technical Triggers

- Gold has achieved all bullish targets up to $3320 (Rs 95300). Now it’s time to be very cautious, as all negative news is already discounted in the prices and the rally seems to be overstretched. Buying is not advisable as the risk-reward does not match. Short-term weakness can emerge up to $3280 (~Rs 93000) if prices sustain below $3330 (~Rs 95500)

- Silver after achieving the target of $33 (~Rs 96500), the rally seems to be weakening. It’s better to be on the sidelines until a new trend emerges.

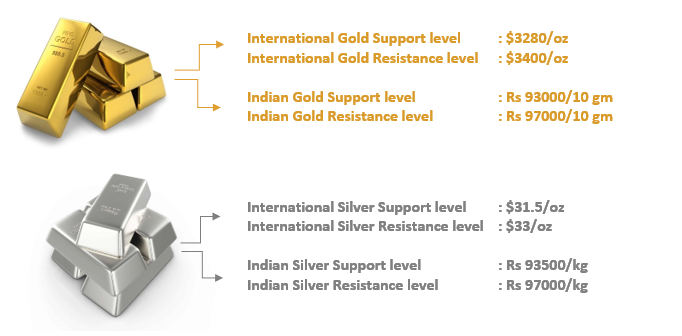

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.