Fundamental News and Triggers

- Active Gold June contract has touched a record high of $3504 (~Rs 99178) today, as the dollar fell to a three-year low below 98. President Trump increased pressure on the Federal Reserve, calling for a dramatic rate reduction and even considering replacing Fed Chair Powell.

- Trump criticized Fed Chair Jerome Powell again on Monday, warning that unless interest rates are cut promptly, the US economy will slow. The comments on Powell reinforced concerns about the Fed’s independence in establishing monetary policy, as well as the outlook for US assets.

- Furthermore, amidst the trade war, China accused the US of abusing tariffs and warned governments, not to seek an agreement with the US that compromised Beijing’s interests.

- Together, these considerations have led to strong safe-haven demand for gold, which is now up 30% this year.

Technical Triggers

- After touching $3500, positioning appears crowded in the short run, and technical indications suggest near-term overbought condition. Therefore, one must exercise extreme caution because prices have skyrocketed in a relatively short period.

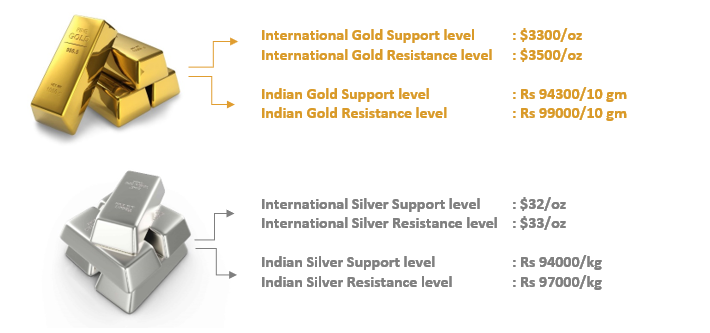

- If prices fall below $3450 (~Rs 97000), we may see a topping-out signal and profit-booking can move prices southward to around $3300 (~Rs 94000).

- Silver prices have been trading in the range of $32 (~ Rs 94000) and $33 (~ Rs 97000) and are expected to continue same range this week.

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.