Fundamental News and Triggers

- President Donald Trump’s new tariff threat fueled demand for safe-haven assets, helping gold rise more than 1% to above $3370 (~Rs 96000), its highest level in almost a week.

- Concerns about a possible escalation of the global trade war have increased after President Trump announced his proposal to impose 100% tariffs on foreign-produced films, which has caused investors to turn to gold and other traditional safe-haven assets.

- Investors are currently anticipating the Federal Reserve’s policy decision and the speeches that several Fed officials are scheduled to give this week. Despite tensions over global trade, the strong non-farm payroll data released last Friday showed that U.S. hiring was still strong, indicating that the economy is resilient. Interest Rates are expected not to change at this meeting.

- President Trump is putting increasing pressure on the Federal Reserve to cut interest rates, but his tariff policies run the risk of making inflationary pressures worse, which makes policymaking more difficult.

Technical Triggers

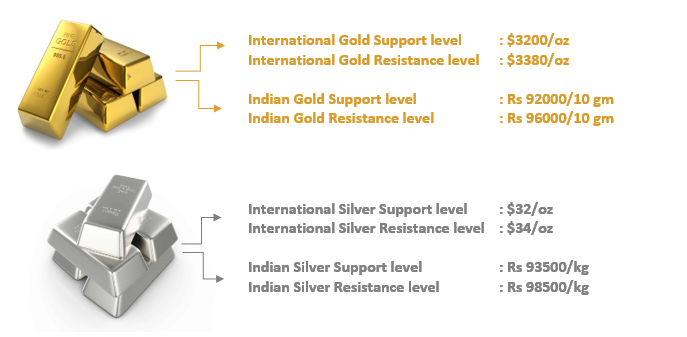

- Gold prices retraced to the $3210 level last week, a 50% Fibonacci retracement of its rally from $2970 (~Rs 86650) to $3510(~Rs 99350). Now prices are expected to consolidate between $3210(~Rs 92000) to $3380(~Rs 96000), either side breakout or breakdown will set a new direction for the prices for the coming days.

- Silver prices are expected to consolidate between $32 (~Rs 93500) and $34(~Rs 98500).

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.