Fundamental News and Triggers

- Gold’s haven status has been underlined this week as it approaches $3240 (~Rs 92400). President Donald Trump’s flip-flopping message on his tariff plan sparks frenzied selloffs for US stocks, Treasuries, and the currency, as worries of a global recession grip Wall Street.

- Even after his 90-day tariff freeze on higher levies that struck dozens of trade partners, charges on all Chinese imports have risen to at least 145%, with Beijing threatening to retaliate with 84% tariffs.

- The Dollar Index has fallen below 100 as central banks around the world sell US bonds and increasingly buy gold.

- Tensions between the two countries have reignited fears of a US recession on the way. On Thursday, statistics indicated that underlying US inflation fell broadly in March, with traders now pricing in expectations for three interest-rate cuts in the remainder of the year, with the possibility of a fourth.

Technical Triggers

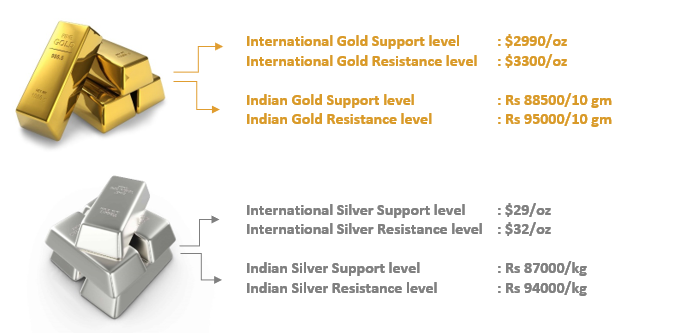

- The gold active June contract has one way rallied from $3000 to $3240 in the last two days. The next resistance target is $3300(~Rs 95000).

- Silver has excellent support at $29 (about Rs 87000). Every decline below $30 (~Rs 89000) should be viewed as a buying opportunity for targets of $32 (~Rs 94000).

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.