You can invest your money in a variety of assets as an investor, including equity, debt, gold, and real estate, among others. Asset allocation is the process of putting money into one or more of these assets. The specific asset mix in your investment portfolio is determined by the length of years you want to devote to achieving your objectives and your risk tolerance. Following are the rules to create your asset allocation plan

- Set your Goals before investing

Your asset allocation should remain constant regardless of the expected returns from various assets. Rather, your asset allocation should be determined by your investing objective, risk tolerance, and the number of years remaining to reach your financial objectives. However, based on actual performance, you may need to rebalance your portfolio to stay on track with your initial asset allocation plan in order to achieve your long-term objectives.

- Don’t shuffle your Investments in the short-term

It’s important to resist the urge to move money from one asset to another based on short-term success. If you’ve already allocated cash to assets based on your medium-to-long-term objectives, you don’t need to worry about the shorter events. Juggling between assets and investments incurs cost and may prove futile over the long term.

- Diversification of Assets can help make better returns

It has long been proven that the long-term performance of major asset classes does not correlate. The performance of different asset classes is influenced by characteristics that are specific to them. When economic and other variables have a beneficial impact on one asset class, they frequently have a negative impact on another.

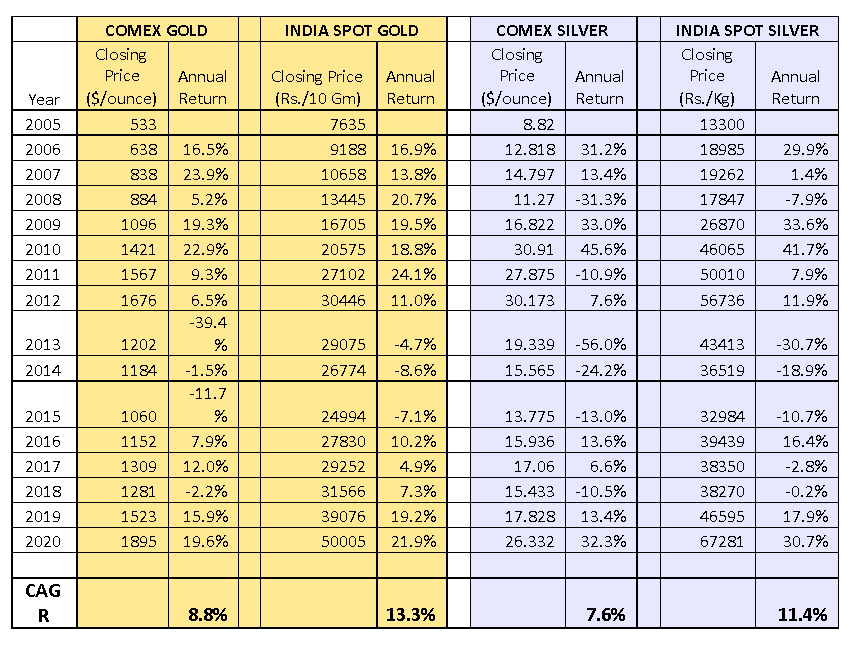

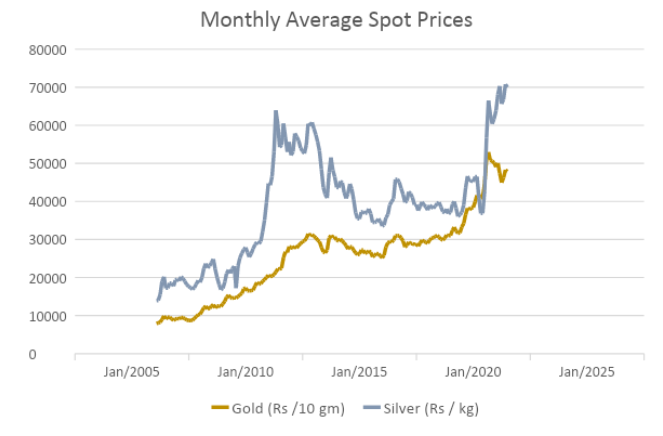

If you look at the long-term 15 years, Gold and Silver has outperformed Nifty in returns. Gold has given CAGR returns of 13.3%, Silver 11.4% while Nifty gave around 11.2%. With the ultra-low interest rate for a prolonged period, high inflation, depreciating currency and little skeptical about economic growth, one should allocate around 15% to 20% of a portfolio to gold and silver.

Gold and Silver price performance in last 15 years